| Table of Contents |

|---|

Key Points

...

States That Don't Tax Income

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming

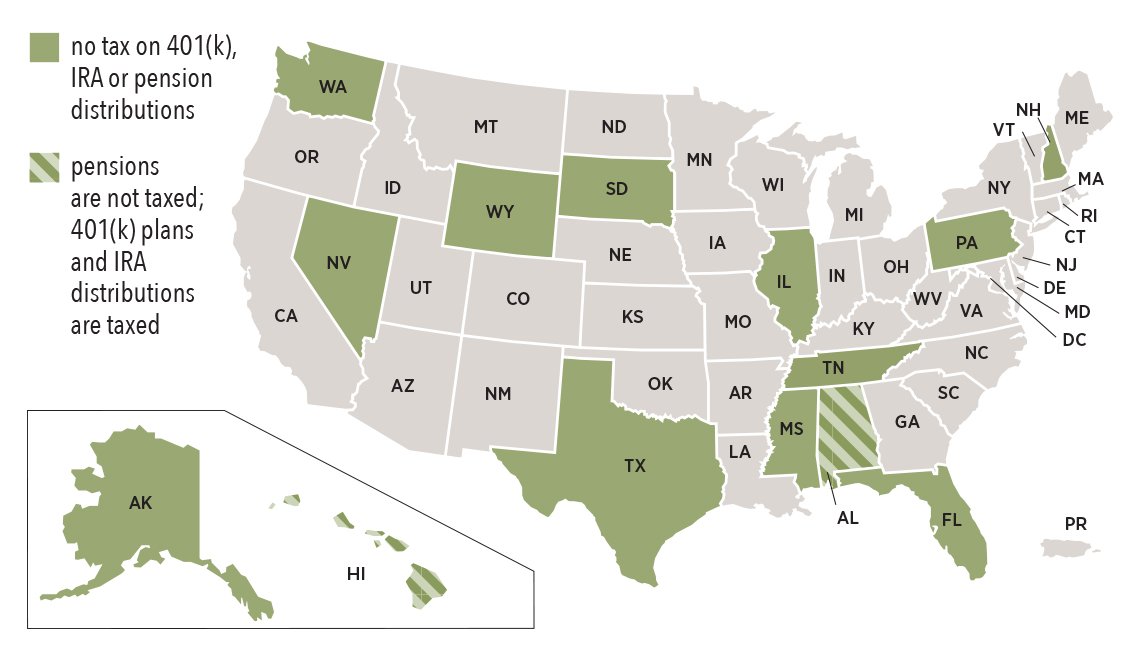

States That Don't Tax Retirement Distributions

Expenses and Taxes on Real Estate Home Sales

Federal Captial Gains Taxes on a Primary Home owned for 5 years

Assume 15% on capital gain based on income

Capital gain is the net sales proceeds of the house minus the cost of the home plus improvements

States also impose sales tax fees on house sales ( MA = 0.005 percent of the gross sales price )

Other fees for title searches, septic, transfer docs etc

Real Estate commissions are negotiable - don't always accept 5 or 6%

https://www.yahoo.com/finance/news/why-real-estate-commissions-6-225830372.html

Tax Planning Documents

taxes folder for the year

...

Another way to reduce RMDs is by buying a deferred income annuity. You can invest up to 25% of your IRA or 401(k) account (or $135,000, whichever is less) in a type of deferred income annuity known as a qualified longevity annuity contract (QLAC). When you reach a specified age, which can be as late as 85, the insurance company turns your deposit into payments that are guaranteed to last the rest of your life

The portion of savings used for the annuity is excluded from the calculation to determine your RMDs. For example, if you have $500,000 in an IRA and transfer $100,000 into a QLAC, your RMD is based only on the remaining $400,000. This doesn’t eliminate your tax bill—it just defers it. The taxable portion of the money you invested will be taxed when you start receiving income from the annuity.

QLACs offer other advantages to retirees who want guaranteed income later in life. Because you’re deferring the income stream, payouts are much higher for deferred income annuities than they are for immediate annuities, which start payouts right away. For example, a 65-year-old man who invests $100,000 in an immediate annuity will receive a payout of $493 a month, according to www.immediateannuities.com. That same amount invested in a deferred-income annuity that begins payments at age 80 would pay $1,663 a month.

define options for accumulation period, investment guaranteed minimum returns, principal return to beneficiaries etc

Medicare Premium Fees for Part B for 2024

...