Tax Concepts

IRS Tax rates based on Marital Status 2021

less discriminatory on married filing single than in past years prior to 2017

Medicare Premiums Based on Marriage Status

2022 Medicare Premiums based on marital status

IRA deduction contribution limits based on Marriage Status and MAGI

Capital Gains for Real Estate based on Marriage filing status

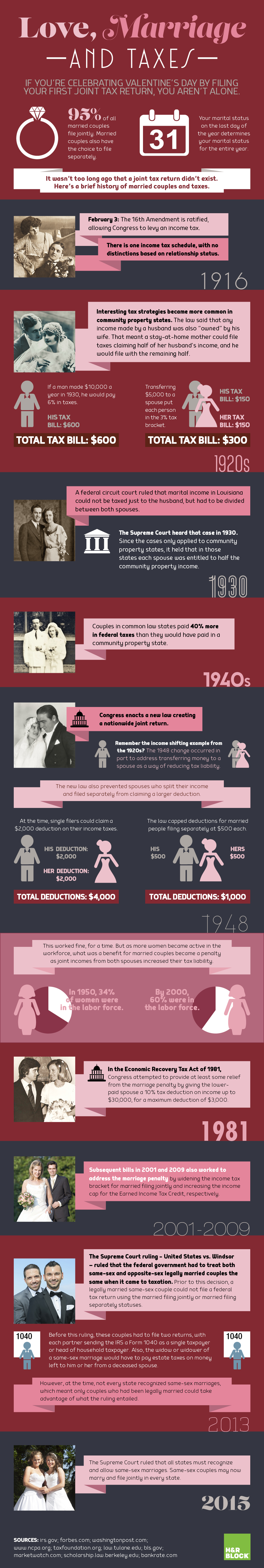

The marriage tax penalty

https://www.hrblock.com/tax-center/filing/personal-tax-planning/how-filing-jointly-came-to-be/

Married Filing Separately is a Targeted Punishment by Democrats

see IRS, Social Security Medicare, IRA contribution amounts

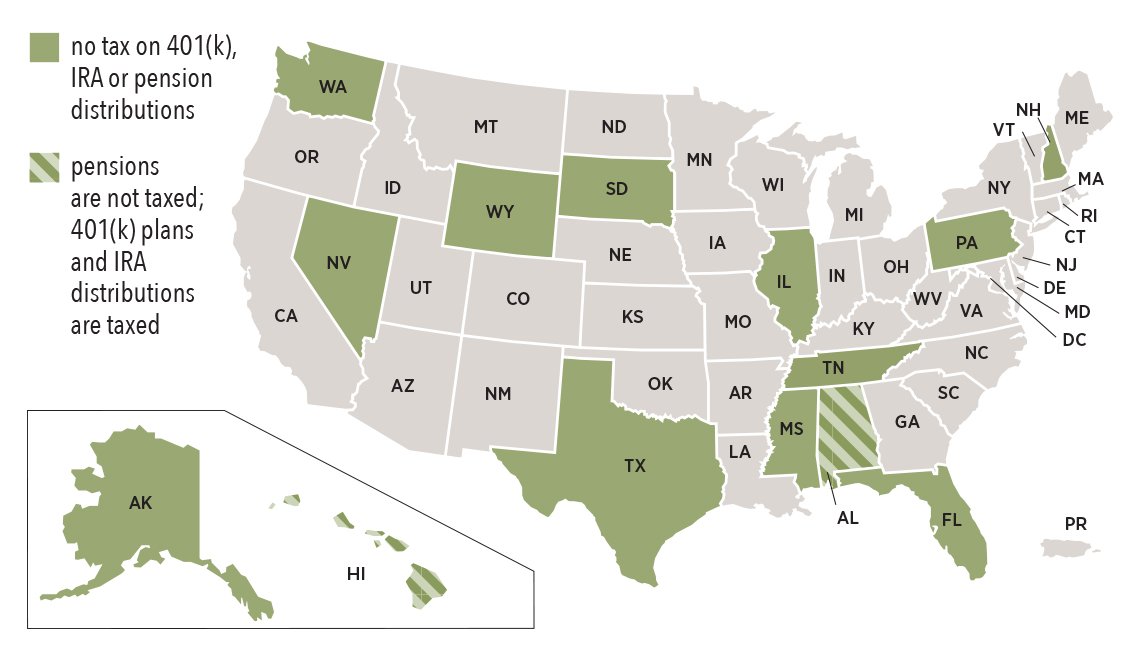

States That Don't Tax Income

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming

States That Don't Tax Retirement Distributions

Tax Planning Documents

taxes folder for the year

collect all related tax documents ( taxes paid, w2 forms, 1099 forms etc )

create a year folder for the tax years documents

software folder for tools - reformat fmr net gains csv for each taxable account or use txf tool to reformat taxable net gains

C:\Users\Jim Mason\Google Drive\_save\Finance\taxes txf_added-notes.txt

see _my_financial management and taxes.docx

D:\dsfw\apps\hrblock for year tax software and year-data

C:\Users\Jim Mason\Google Drive\_save\Finance\tools\txf_creator

Tasks

...

- view the Fidelity tax form csv data does not have the symbol for the cusip

- must construct symbol in groovy app as csv from this description

PUT BAC $34 EXP 05/21/2021 BAC210521 5014619BZ

BAC21051P34

- must construct symbol in groovy app as csv from this description

- query closed positions for the year under each account does not have the acquire and sale dates

- GROOVY pgm to read fmr tax csv and generate the txf csv fmt

Symbol,Quantity,Date Acquired,Cost,Date Sold,Proceeds,Gain

...

columns for TXF input file - TXFCreator only reads up to "Gain" column – rest is to automatically set dates using ST or LT gain info

...

Task - Convert taxable net gains csv file to TXF format

C:\Users\Jim Mason\Google Drive\_save\finance\taxes

from shell on macos at home >> cd

/Volumes/GoogleDrive/'My Drive'/_save/finance/taxes_tax-notes2.txt

//=======================================

x140 ATP history reported

select only buy sell transactions

select only closed orders

shows gain / loss query by closed order with dates

use to create csv or xls for download to edit

after edit, export csv in matching format for txf-express tool

...

Double click the txf-creator.jar file to launch TXF Creator.

**********************************************************************

TXF Creator (Version 4.0) README.TXT

Copyright (c) 2008 TXF Express LLC December 2008

TXF Creator is a software product developed by TXF Express LLC, which

allows a user to convert stock trades from multiple brokerage accounts

to TXF (Trade eXchange Format) files with just a few clicks of the

mouse. The user can import stock trades into any tax software program

that accepts TXF such as TurboTax and TaxCut.

...

https://github.com/andreasg123/stock-gain-tax-import/issues/1

...

run free online conversion

...

NEW >> download the 1099 csv file from accounts > tax information > 1099 forms > csv files for each account's

-------------------------------------------

Convert a net gain csv file in workbook

Option 1 NEW >> use libre office calc to convert to csv from 1099 formating

remove all but detail records

remove unneed columns

create gain column as sum of cost, proceeds columns

rearrange columns to meet txf format above

save as csv file

...

Your CSV file should have ONLY the following six (6) columns in this EXACT order

(headers are optional):

Symbol Quantity Date Acquired Cost Date Sold Proceeds Gain

AAPL 100 10/01/2015 $21895.50 11/15/2015 30125.25 8170.25

...

jim-tax-symbol-parse.groovy

Key Concepts

Tax Planning

Retirement RMD rules

tax-RMD-2021-rule-changes-This retirement rule will be back with a vengeance in 2021.pdf gdrive

No RMD in 2020

RMD required in 2021 from all retirement accounts

RMD options

- Withdrawals that rollover to IRA - pay taxes separately to role the full amount

- Plan Withdrawal to MAYBE use a larger amount IF the tax bracket max is NOT hit

- Plan Roth conversions given the risk that Roth conversions may be eliminated by Congress in 2022

- Rollover 401k to IRA - sets up for a Roth IRA conversion

- IRA to Roth IRA - taxable event

Purchase deferred annuity to reduce current income

Another way to reduce RMDs is by buying a deferred income annuity. You can invest up to 25% of your IRA or 401(k) account (or $135,000, whichever is less) in a type of deferred income annuity known as a qualified longevity annuity contract (QLAC). When you reach a specified age, which can be as late as 85, the insurance company turns your deposit into payments that are guaranteed to last the rest of your life

The portion of savings used for the annuity is excluded from the calculation to determine your RMDs. For example, if you have $500,000 in an IRA and transfer $100,000 into a QLAC, your RMD is based only on the remaining $400,000. This doesn’t eliminate your tax bill—it just defers it. The taxable portion of the money you invested will be taxed when you start receiving income from the annuity.

QLACs offer other advantages to retirees who want guaranteed income later in life. Because you’re deferring the income stream, payouts are much higher for deferred income annuities than they are for immediate annuities, which start payouts right away. For example, a 65-year-old man who invests $100,000 in an immediate annuity will receive a payout of $493 a month, according to www.immediateannuities.com. That same amount invested in a deferred-income annuity that begins payments at age 80 would pay $1,663 a month.

define options for accumulation period, investment guaranteed minimum returns, principal return to beneficiaries etc

Potential Value Opportunities

Potential Challenges

...

| Table of Contents |

|---|

Key Points

References

...

C:\Users\Jim Mason\Google Drive\_save\Finance\tools\software

https://drive.google.com/open?id=0BxqKQGV-b4WQSnFEdmp0WlRIdTA

...

| Table of Contents |

|---|

Key Points

References

| Reference_description_with_linked_URLs__________________________ | Notes__________________________________________________________________ |

|---|---|

| mason-fin-plan1. gd | |

| invest-analysis1. gd | |

| jm estate plan1. gd | |

| C:\Users\Jim Mason\Google Drive\_save\Finance\tools\txf_creator | TXF Creator to build TXF net gains files for import to HR Block |

C:\Users\Jim Mason\Google Drive\_save\Finance\tools\software https://drive.google.com/open?id=0BxqKQGV-b4WQSnFEdmp0WlRIdTA | TXF Creator to build TXF net gains files for import to HR Block |

| https://finance.yahoo.com/news/7-end-wealth-moves-094206315.html | Year end smart financial planning and tax moves ** |

| IRS online estimated payments - direct pay. ** | |

| MA DOR online estimated payments. ** | jm9-Syn# |

| tax folder | |

| tax planning doc - tax-notes2 gdoc. *** | |

| SkyPalms folder in finance | |

| Florida Beneficial Ownership reporting for LLC initial report filing dates info | |

Taxes for Dummies - 2024.pdf link *** | Part 5 and 6 are useful guidelines on minimizing taxes with some good wealth building tips as well. SWH - Smart Wealth Help has many part 5 items including the JimK plan |

| Future Value Calculator link **** | easily shows the value of compound interest for many scenarios > very helpful calculator.net. has many other calculators including mortgage ones |

Tax Concepts

IRS Tax rates based on Marital Status 2021

less discriminatory on married filing single than in past years prior to 2017

Medicare Premiums Based on Marriage Status

2022 Medicare Premiums based on marital status

IRA deduction contribution limits based on Marriage Status and MAGI

Capital Gains for Real Estate based on Marriage filing status

The marriage tax penalty

https://www.hrblock.com/tax-center/filing/personal-tax-planning/how-filing-jointly-came-to-be/

Married Filing Separately is a Targeted Punishment by Democrats

see IRS, Social Security Medicare, IRA contribution amounts

States That Don't Tax Income

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming

States That Don't Tax Retirement Distributions

Expenses and Taxes on Real Estate Home Sales

Federal Captial Gains Taxes on a Primary Home owned for 5 years

Assume 15% on capital gain based on income

Capital gain is the net sales proceeds of the house minus the cost of the home plus improvements

States also impose sales tax fees on house sales ( MA = 0.005 percent of the gross sales price )

Other fees for title searches, septic, transfer docs etc

Real Estate commissions are negotiable - don't always accept 5 or 6%

https://www.yahoo.com/finance/news/why-real-estate-commissions-6-225830372.html

Senior Tax Management - Capital Gains Strategies and More

Capital Gains Tax Summary

- You must pay capital gains on profits from investments.

- Long-term gains — gains from assets you’ve held for more than one year — are taxed at a maximum rate of 20%.

- Short-term gains — money generated from assets you’ve sold after owning them for less than one year — get taxed at your particular ordinary income tax rate.

- You can reduce your capital gains tax liability with several strategies, including tax-loss harvesting, charitable giving and estate planning.

Capital Gains Tax Age Limit and Tax Strategies. - financestrategists

Understanding Capital Gains Tax

Differences in CGT Application: Minors vs Adults

Special Age-Related Tax Considerations

Capital Gains Tax Strategies for Different Age Groups

Role of Professional Tax Planning

Understanding Capital Gains Tax Age Limit and Tax Strategies FAQs

State Tax Breaks for Elderly Tax Payers - itep.org

Most States Offer Additional Elderly Tax Breaks

Most states that levy income taxes go beyond the tax preferences for the elderly inherited from federal income tax rules and allow special elderly-only tax breaks of their own. Many states also provide property tax breaks available only to homeowners (and in some cases renters) over 65. For a list of tax breaks by state, see the chart at the end of the brief.

- All Retirement Income: Three states with a broad-based income tax (Illinois, Mississippi, and Pennsylvania) fully exempt all retirement income from taxation. This includes private and public pensions, Social Security, and annuities.

- Property Tax Reductions: 22 of the 30 states that provide a property tax credit limit the credit’s availability to senior citizens, or provide a more generous version of the credit to older adults. In some states, the credits are calculated based on the relationship between income and property taxes (a circuit breaker) and in others the credits are simply based on age and income. Many states also offer homestead exemptions, which shelter a certain amount of a home’s value from tax, that are larger for senior citizens than for other taxpayers.

charts > state-income-tax-subsidies-for-seniors-maps-2023/

shows the states with no income tax in gray

https://itep.sfo2.digitaloceanspaces.com/elderlypreferencespb.pdf

Some 2025 IRS Tax Law Changes

Tax Planning Documents

taxes folder for the year

collect all related tax documents ( taxes paid, w2 forms, 1099 forms etc )

create a year folder for the tax years documents

software folder for tools - reformat fmr net gains csv for each taxable account or use txf tool to reformat taxable net gains

C:\Users\Jim Mason\Google Drive\_save\Finance\taxes txf_added-notes.txt

see _my_financial management and taxes.docx

D:\dsfw\apps\hrblock for year tax software and year-data

C:\Users\Jim Mason\Google Drive\_save\Finance\tools\txf_creator

Tasks to prepare for Tax returns

- get hrblock software for the year

- update hrblock software - HRBlock2019.exe - Shortcut ( online or manual download of updates )

- For capital gains TXF data - see these 3 options ( Option 1 should work well )

- Option 1 - edit the Fidelity csv file to get the selected columns and headings needed for the TXF format 4 record below

if that fails due to bad Fidelity csv format - Option 2 - use a custom Groovy pgm to create taxable net gains from fin svcs ( like Fidelity )

- view the Fidelity tax form csv data does not have the symbol for the cusip

- must construct symbol in groovy app as csv from this description

PUT BAC $34 EXP 05/21/2021 BAC210521 5014619BZ

BAC21051P34

- must construct symbol in groovy app as csv from this description

- query closed positions for the year under each account does not have the acquire and sale dates

- GROOVY pgm to read fmr tax csv and generate the txf csv fmt

Symbol,Quantity,Date Acquired,Cost,Date Sold,Proceeds,Gain

- view the Fidelity tax form csv data does not have the symbol for the cusip

- use HR Block import financial data first based on your Fidelity login credentials

if that fails - Option 3 - use Fidelity ATP to create a csv file with the right columns for net gains

- use Fidelity ATP to get the financial net gains and download as an .xls file

- ATP > accounts > select account > select close positions > select period > view table > expand EVERY trade for lots > RB menu > export to xls

- optional — use groovy to create lot level details for every trade in TXF input format OR just assign default dates to summary lines based on CAP gain as LT or ST

columns for TXF input file - TXFCreator only reads up to "Gain" column – rest is to automatically set dates using ST or LT gain info

Symbol Quantity Date Acquired Basis Date Sold Proceeds Gain Short-Term G/L Long-Term G/L Basis/Share Proceeds/Share - use txf software to convert net gains csv to file.txf format

- get credit card, bank details as csv files for the year and categorize by expense type

- load last year's returns after starting a new return

- get last year's tax payments, refunds

- get last year's taxes paid ( property tax etc )

i>> HR Block forms don't allow paste - look at AHK for Windows or ?? for Linux

AHK for Windows to paste to HR Block forms

https://www.bogleheads.org/forum/viewtopic.php?t=319687

AHK for Linux to paste to HR Block forms >> none that can work with HR Block

Task - Convert taxable net gains csv file to TXF format

TXF File formats defined - use format 4 for stock sales

https://taxdataexchange.org/docs/txf/v042/index.html

use terminal on cd Google drive to run TXF creator in Windows ( run.bat ) or Linux ( run.sh )

C:\Users\Jim Mason\Google Drive\_save\finance\taxes

from shell on macos at home >> cd

/Volumes/GoogleDrive/'My Drive'/_save/finance/taxessee more details on TXF in _tax-notes2.txt

//=======================================

x140 ATP history reported

select only buy sell transactions

select only closed orders

shows gain / loss query by closed order with dates

use to create csv or xls for download to edit

after edit, export csv in matching format for txf-express tool

//=======================================

x150 txf conversion from fidelity csv

Double click the txf-creator.jar file to launch TXF Creator.

**********************************************************************

TXF Creator (Version 4.0) README.TXT

Copyright (c) 2008 TXF Express LLC December 2008

TXF Creator is a software product developed by TXF Express LLC, which

allows a user to convert stock trades from multiple brokerage accounts

to TXF (Trade eXchange Format) files with just a few clicks of the

mouse. The user can import stock trades into any tax software program

that accepts TXF such as TurboTax and TaxCut.

github txf oss tool

https://github.com/andreasg123/stock-gain-tax-import/issues/1

OR

run free online conversion

this worked for load in 2017 to hr block with valid csv file

-------------------------------------------

get the net gain csv file from Fidelity

OLD >> use ATP custom query on closed transactions for the year-on-year

export as csv

NEW >> download the 1099 csv file from accounts > tax information > 1099 forms > csv files for each account's

-------------------------------------------

Convert a net gain csv file in workbook

Option 1 NEW >> use libre office calc to convert to csv from 1099 formating

remove all but detail records

remove unneed columns

create gain column as sum of cost, proceeds columns

rearrange columns to meet txf format above

save as csv file

-------------------------------------------

FORMAT FOR TXF CSV file

Your CSV file should have ONLY the following six (6) columns in this EXACT order

(headers are optional):

Symbol Quantity Date Acquired Cost Date Sold Proceeds Gain

AAPL 100 10/01/2015 $21895.50 11/15/2015 30125.25 8170.25

Option 2 OLD >> - parse with groovy

jim-tax-symbol-parse.groovy

Free Online TXF file generator

Get Started

Follow these steps:

Click Choose CSV File to pick your .CSV file to upload

Click Convert and if prompted select "save to file".

Import the downloaded TXF file in TurboTax.

Your CSV file should have ONLY the following six (6) columns in this EXACT order

(headers are optional):

Symbol Quantity Opening Date Opening Net Amount Closing Date Closing Net Amount

AAPL 100 10/01/2018 $21895.50 11/15/2018 30125.25

Important: Make sure you save as a CSV file with a .csv file extension. You can use Excel , Google Sheets or OpenOffice to rearrange columns if needed and save as a new .csv file.

Property Exchange Solutions - 721 REIT, 1031 Exchanges

721 REIT DST

some really smart people figured out a way to purchase a DST property and bring that property and its investors into their REIT. With as little as $250,000, an investor can buy a particular type of DST that converts to a REIT in a few years, thus making the 721 exchange a more democratic and viable option. This type of Delaware Statutory Trust is quickly becoming the most popular DST with good reason.

The IRS code section 721 allows an investor to transfer property held in a like-kind exchange for shares in a Real Estate Investment Trust (REIT) without triggering the 20-30% capital gains tax from a traditional sale. If the REIT is held indefinitely, the beneficiaries receive a step up in basis, thus eliminating the capital gain tax. While in the REIT, the owner receives tax-advantaged income throughout their lives.

One of the many benefits of section 721 exchanges is that they allow investors to increase their investment liquidity and portfolio diversification while deferring the payment of capital gains and depreciation recapture taxes when relinquishing their properties. Furthermore, 721 tax-deferred exchanges generate passive income for investors, allowing them a hands-off approach. At the same time, managers handle the day-to-day decision-making process for the portfolio while communicating about acquisitions, dispositions, and distributions.

Using Delaware Statutory Trusts (DSTs) in a 1031 Exchange to 721 Exchange & 721 UPREIT

- A REIT creates a temporary Delaware Statutory Trust (DST), allowing 1031 exchangers to purchase or invest in the DST under section 1031.

- After a safe harbor period of approximately two years, the REIT absorbs the DST into its portfolio utilizing section 721. This makes the 1031 exchanger a temporary DST investor, and the due diligence should be focused on the REIT portfolio instead of the individual temporary DST.

- After process completion, the 1031 exchanger owns the REIT.

Why is the 721 DST more appealing than the Traditional DST? The table at the end sets out the major differences, but, in our experience, what compels investors to go the 721 DST route are just five things since they both can defer and eliminate taxes through the step-up in basis.

- The 721 DST is liquid and available to the investor after approximately three years vs. providing liquidity for only 45 days every 4-10 years with a Traditional DST.

- The 721 DST is a sizeable multi-billion portfolio of institutional quality assets diversified by real estate asset class and geography, thus making both the risks and the returns more predictable vs. the single asset Traditional DST with an average equity raise of under $50 million.

- Once you complete a 1031 exchange into a DST that converts to a REIT, you do not have to do another one.

- Over time, the significantly lower initial and ongoing costs of a 721 DST create significantly more equity or value for the investor than the Traditional DST. See our post “Fees Matter” for details.

- Regulatory Risk. If the 1031 exchange is eliminated, then once a DST expires, the investor will be forced to pay taxes. With the 721 DST, the regulatory risk of 1031 legislation is taken off the table.

Most traditional DSTs hold single asset classes, typically single properties. The expected holding period lasts approximately five to seven years, then is liquidated and carries roughly a 15 percent cost at initial purchase and 5 percent upon disposition or sale. The idea of Traditional DSTs is to defer, rollover, defer, rollover, eventually passing away and avoiding taxes. It was a viable exit strategy until the 721 DST came along.

We like to give 721 DSTs different names based on their function. We sometimes call them Hybrid DSTs; other times, we call them Convertible DSTs; other times, Shape-shifter DSTs, and Final Destination DSTs. Why four names? Because a 721 DST acts precisely like a Traditional DST for approximately the first 2-year period until it shape-shifts or converts into ownership of operating partnership units in a Public Non-Listed REIT. This REIT becomes the investor’s final destination, so this hybrid is part Traditional DST, and soon after purchase, it becomes a REIT.

Sera Capital’s IRC 721 advisors still utilize Traditional DSTs for approximately 25 percent of our consulting practice clients as appropriate for the client situation. In comparison, the remaining 75 percent recognize the benefits of the 721 DST. We uniquely positioned ourselves to provide both Traditional and 721 DSTs and Qualified Opportunity Zone funds to steer clients into appropriate solutions among all three, then into specific investments. For more information regarding our 721 Exchange services,

Key Concepts

Tax Planning

2024 Secure Act Retirement Tax Change Summary

Many of these changes stem from the SECURE Act 2.0, passed by Congress at the end of 2022, which overhauled aspects of the American retirement system. Among the most powerful:

- Defined contribution retirement plans would be able to add an emergency savings account giving participants penalty-free access to funds.

- Older workers will be able to contribute more to their 401(k)s and other qualified retirement accounts.

- Required minimum distributions (RMDs) from workplace Roth 401(k)s will become a thing of the past.

- Employers will be allowed to reward student loan payments by employees with matching contributions into their retirement accounts.

- And rolling over unused funds in a 529 college savings plan to a Roth IRA just got a whole lot easier.

Taken together, these adjustments can help with retirement planning and provide a boost to your savings. Here are the details.

IRS suspends RMDS for beneficiaries again in 2024 from inherited IRAs helping fix the Secure Act 2.0 problems created

Notice 2024-35 does not affect lifetime RMDs. The RMD relief is only for IRA beneficiaries.

EDBs also don’t qualify for this RMD relief. Since they’re not subject to the 10-year rule, their 2024 RMDs must still be taken.

FIVE CLASSES OF ELIGIBLE DESIGNATED BENEFICIARIES

- Surviving spouses.

- Minor children of the account owner, until age 21 — but not grandchildren.

- Disabled individuals — under the strict IRS rules.

- Chronically ill individuals.

- Individuals older than, or not more than 10 years younger than, the IRA owner.

The IRS reprieve also does not apply to RMDs for beneficiaries who inherited before 2020. Those beneficiaries are subject to the pre-SECURE Act rules, which allow any designated beneficiary to do the stretch.

The relief only applies to those beneficiaries who inherit after 2019 and who were originally subject to annual RMDs within the 10-year period. The new IRS relief, combined with the prior relief, means these beneficiaries will have no annual RMDs until at least 2025.

Retirement RMD rules

tax-RMD-2021-rule-changes-This retirement rule will be back with a vengeance in 2021.pdf gdrive

No RMD in 2020

RMD required in 2021 from all retirement accounts

RMD options

- Withdrawals that rollover to IRA - pay taxes separately to role the full amount

- Plan Withdrawal to MAYBE use a larger amount IF the tax bracket max is NOT hit

- Plan Roth conversions given the risk that Roth conversions may be eliminated by Congress in 2022

- Rollover 401k to IRA - sets up for a Roth IRA conversion

- IRA to Roth IRA - taxable event

Purchase deferred annuity to reduce current income - Qualified Longevity Annuity Contract (QLAC)

Another way to reduce RMDs is by buying a deferred income annuity. You can invest up to 25% of your IRA or 401(k) account (or $135,000, whichever is less) in a type of deferred income annuity known as a qualified longevity annuity contract (QLAC). When you reach a specified age, which can be as late as 85, the insurance company turns your deposit into payments that are guaranteed to last the rest of your life

The portion of savings used for the annuity is excluded from the calculation to determine your RMDs. For example, if you have $500,000 in an IRA and transfer $100,000 into a QLAC, your RMD is based only on the remaining $400,000. This doesn’t eliminate your tax bill—it just defers it. The taxable portion of the money you invested will be taxed when you start receiving income from the annuity.

QLACs offer other advantages to retirees who want guaranteed income later in life. Because you’re deferring the income stream, payouts are much higher for deferred income annuities than they are for immediate annuities, which start payouts right away. For example, a 65-year-old man who invests $100,000 in an immediate annuity will receive a payout of $493 a month, according to www.immediateannuities.com. That same amount invested in a deferred-income annuity that begins payments at age 80 would pay $1,663 a month.

define options for accumulation period, investment guaranteed minimum returns, principal return to beneficiaries etc

Medicare Premium Fees for Part B for 2024

This details what the rates are and what the coverages are

https://www.humana.com/medicare/medicare-resources/irmaa

Potential Value Opportunities

Earned Income Tax Credit for low to moderate wage earners

https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit-eitc

If qualified, can actually pay money after removing your tax liability based on income levels

Child Care Tax Credit

A credit on taxes for children you care for

Estate Planning - maximize wealth transfers

Plan to minimize Federal, State regulations on inheritance and estate taxes

Know what the limits are for Federal and State inheritance and retirement taxes

Choose your domicile carefully and watch the State liabilities for your children

Build an estate plan from your financial plan and assets

Create a will with an executor and a backup executor designation

Options to minimize taxes on real estate transfers uisng living trust or ?

https://www.yahoo.com/finance/news/generational-wealth-7-reasons-not-183924989.html

Of course, in some instances, bequeathing your home to your children after you die could be the best move. As long as everyone is in agreement on the terms, leaving your home to a child can help preserve generational wealth while giving young adults a head start with a house of their own.

If you decide you want your child or children to take over your home after you die, a trust might be the best way, according to ISVGlaw.com, the website for Melville, NY-based legal firm Schneider, Garrastegui & Fedele. A trust can help your children avoid capital gains taxes on the property, help avoid the hassles of probate, and keep the home under your control until you die.

Gifting Assets to Parents to Create Higher Step up Basis on Inheritance

there is a way to increase the cost basis before a sale.

taking advantage of Section 1014 of the Internal Revenue Code, also known as a step-up in basis.

If you're a wealthy young American and you expect to make a substantial profit on the sale of assets like stocks or real estate, here's how gifting those assets to your parents could help you save a fortune.

So, if you gave stock worth $36,000 to your mom and dad today, you could transfer it tax-free by giving them each $18,000. Say the stock went up in value and was worth $336,000 by the time your second parent died in 20 years, the "cost basis" would reset to $336,000. If you sold the stock for $340,000 at that time, you'd only have to pay capital gains taxes on $4,000. Estate taxes would only be a concern if their estate crosses the threshold.

Potential Challenges

2024 Election Tax Impacts Reviewed

Trump tax plans need more impact analysis ( eg tariffs, small corporate tax raise to 23%, add FICA tax over $1M, keep investment tax the same)

Just extending the TCJA could add up to $4.6 trillion to the federal debt by 2033, according to the Congressional Budget Office.1

Trump has said he would extend the 2017 income tax cuts, paying for them in part by imposing a 10% tariff on imports (60% or more on Chinese goods)

separate tax brackets for assets held longer than 1 year and for qualifying dividends, though the rates remained the same at 0%, 15%, and 20%. The TCJA also retained the 3.8% net investment income tax

Social Security Income Tax removed? ( lowered may be smarter )

rump has suggested he might eliminate all taxes on Social Security benefits. Currently up to 85% of benefits is taxed for a single person with combined income above $34,000 or a couple with combined income of $44,000

changing the tax-deferral status for retirement plans (also referred to as the "Rothification" of 401(k) contributions) << ok IF keeping Roth

Harris tax plans more bad than good - trying to spend more but not lower deficits

Harris supported letting the tax cuts expire but has since endorsed President Biden's proposal to extend the personal income tax cuts for all but those making more than $400,000 a year, offsetting the costs with higher taxes on higher income earners, capital gains and dividends, and corporations.

a minimum 25% tax on total income, including unrealized capital gains

taxing qualified dividends and long-term capital gains at ordinary income rates << hits those trying to build wealth for retirement through unions, 401ks

increased the CTC to $3,600 per child ( there is a point where offering more tax breaks for more children does not make sense for the country )

estate tax exemptions will be cut in half

Harris may advocate for Democratic proposals to either limit or eliminate back-door and mega-back-door Roth IRA conversions << attacks middle class trying to build wealth for retirement

Add Social Security Tax on incomes over $400K — an opportunity defined negatively by Harris << no benefits value but taxing wrong income level

Harris has supported the Biden administration's proposal to subject earnings of more than $400,000 to Social Security taxes as a way to help shore up the Social Security trust fund.

Net investment tax increase << not thought out << behavioral economics – no Democrats understand

Biden 2025 budget proposal calls for increasing the net investment income tax (NIIT) to 5% from 3.8% for people with earned income of $400,000

Harris has proposed increasing the corporate tax rate to 28% from 21%. << kills the economy if more than 23%

Candidate Solutions

401K Record Keeping Systems Summary

q>> what are the detail responsibilities and tasks for 401k RecordKeeping systems. Define the summary process flow models in a diagram and detail each process and the systems tasks and interfaces needed to support that process in separate steps

an overview of 401k recordkeeping systems, including responsibilities, tasks, and a summary process flow. Let's break this down into steps:

- Summary Process Flow Diagram

Here's a high-level process flow diagram for a 401k recordkeeping system:

| |

v v

[Investment Management] <--> [Account Maintenance] <--> [Reporting]

^ ^

| |

[Distributions] <------------------------------ [Compliance]

Now, let's detail each process and the associated tasks and interfaces:

- Plan Setup

Tasks:

- Define plan rules and features

- Set up employer information

- Configure investment options

- Establish contribution limits and matching rules

Interfaces:

- Plan document management system

- Employer database

- Investment platform integration

- IRS compliance database

- Employee Enrollment

Tasks:

- Collect employee information

- Process enrollment forms

- Set up individual accounts

- Provide enrollment confirmations

Interfaces:

- Employee database

- Online enrollment portal

- Account management system

- Communication system (email, mail)

- Contributions

Tasks:

- Process payroll deductions

- Allocate employer contributions

- Invest funds according to employee elections

- Update account balances

Interfaces:

- Payroll system integration

- Contribution tracking system

- Investment trading platform

- Account balance database

- Investment Management

Tasks:

- Monitor fund performance

- Process fund transfers and rebalancing

- Update investment options

- Provide investment education materials

Interfaces:

- Investment performance tracking system

- Trading platform

- Fund information database

- Educational content management system

- Account Maintenance

Tasks:

- Process address and beneficiary changes

- Handle loan requests and repayments

- Manage hardship withdrawals

- Update vesting schedules

Interfaces:

- Account information database

- Loan management system

- Withdrawal processing system

- Vesting calculation engine

- Reporting

Tasks:

- Generate account statements

- Provide online account access

- Produce required regulatory reports

- Create plan sponsor reports

Interfaces:

- Reporting engine

- Online portal

- Regulatory compliance system

- Data analytics platform

- Compliance

Tasks:

- Perform non-discrimination testing

- Monitor contribution limits

- Ensure timely filing of required forms

- Conduct audits

Interfaces:

- Compliance testing software

- IRS regulation database

- Form generation and filing system

- Audit management tool

- Distributions

Tasks:

- Process retirement distributions

- Handle rollovers

- Manage required minimum distributions (RMDs)

- Calculate and withhold taxes

Interfaces:

- Distribution processing system

- Tax calculation engine

- Banking integration for fund transfers

- RMD tracking system

This overview covers the main processes involved in 401k recordkeeping systems. Each process requires careful attention to detail, robust system integrations, and strict adherence to regulatory requirements. The interfaces mentioned are crucial for ensuring smooth operations and data integrity across the entire system.

Would you like me to elaborate on any specific aspect of this 401k recordkeeping system overview?

Step-by-step guide for Example

...