| Table of Contents |

|---|

...

https://www.yahoo.com/finance/news/entering-best-real-estate-market-175034281.html

real estate investment trusts (REITs), for example. REITs are not just a platform for investing in residential real estate, offering properties such as retail spaces, large malls, hotels, apartment buildings, office space and hospitals. And though home prices continue to be high, other real estate categories are not as overvalued, potentially shielding investors from the risk of steep price declines.

Dividend Kings

My Higher Yield Picks for Sustainable Payouts

...

lower stock price risk from offerings, market declines

https://seekingalpha.com/article/4631411-energy-transfer-despite-big-risks-tempting-yield

Energy Transfer (NYSE:ET) offers a tempting 9.6% yield. Especially considering the stable fee-based income, the healthy distribution coverage ratio and the ongoing volume growth trajectory. However, there are variety of big risk factors that investors should consider, including debt levels, master limited partnership (“MLP”) tax considerations, a somewhat undisciplined management team, the lack of a strong competitive moat, rising interest rates, regulations, environmental concerns and the overall volatility profile of the industry

Management >> "Energy Transfer continues to “target a 3% to 5% annual distribution growth rate, while… maintaining sufficient cash flow to invest in our incredible backlog of growth opportunities.”

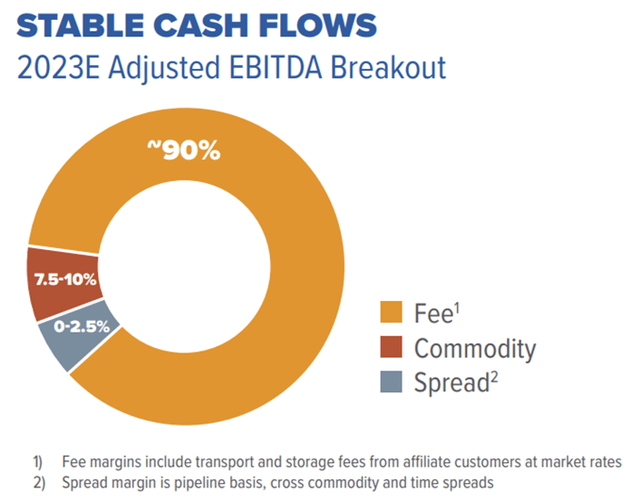

Low earnings impact from volatile energy prices

Debt management doing well

Risks

Competition risks ( medium - it's a regulated industry BUT capacity demand can vary impacting contract prices )

energy price volatility ( some risk )

Debt to income risk ( managed so far )

Regulatory risks

Regulations and environmental considerations pose another risk the company has to deal with. For example, in 2022 Energy Transfer was charged with environmental crimes

Energy Transfer Key Presentations

Energy-Transfer-Q3-2023-Earnings-Presentation-url

ET-231101-Q3 2023 Earnings Presentation_Final2.pdf link

2023 Dividend Kings List

https://www.suredividend.com/dividend-kings/

...