Key Points

References

| Reference_description_with_linked_URLs__________________________ | Notes__________________________________________________________________ |

|---|---|

| C:\Users\Jim Mason\Google Drive\_save\Finance\tools\txf_creator | TXF Creator to build TXF net gains files for import to HR Block |

C:\Users\Jim Mason\Google Drive\_save\Finance\tools\software https://drive.google.com/open?id=0BxqKQGV-b4WQSnFEdmp0WlRIdTA | TXF Creator to build TXF net gains files for import to HR Block |

| https://finance.yahoo.com/news/7-end-wealth-moves-094206315.html | Year end smart financial planning and tax moves ** |

| IRS online estimated payments - direct pay | |

| MA DOR online estimated payments | jm9-Syn# |

Tax Concepts

IRS Tax rates based on Marital Status 2021

less discriminatory on married filing single than in past years prior to 2017

Medicare Premiums Based on Marriage Status

2022 Medicare Premiums based on marital status

IRA deduction contribution limits based on Marriage Status and MAGI

Capital Gains for Real Estate based on Marriage filing status

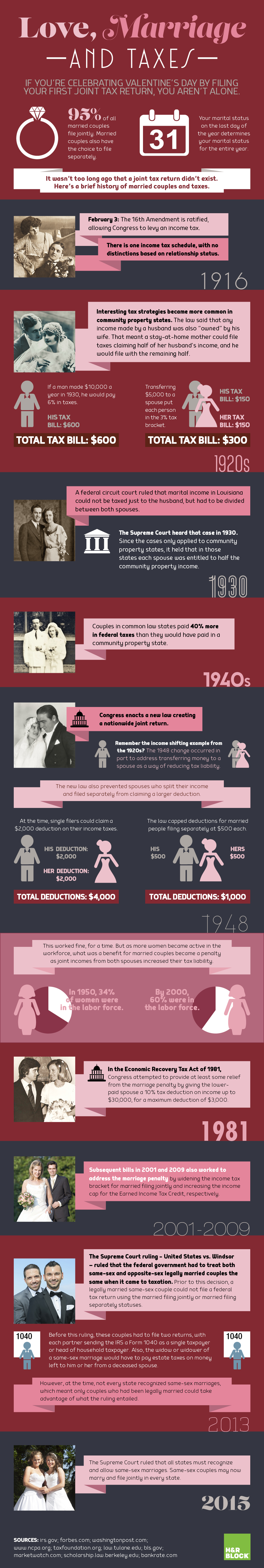

The marriage tax penalty

https://www.hrblock.com/tax-center/filing/personal-tax-planning/how-filing-jointly-came-to-be/

Married Filing Separately is a Targeted Punishment by Democrats

see IRS, Social Security Medicare, IRA contribution amounts

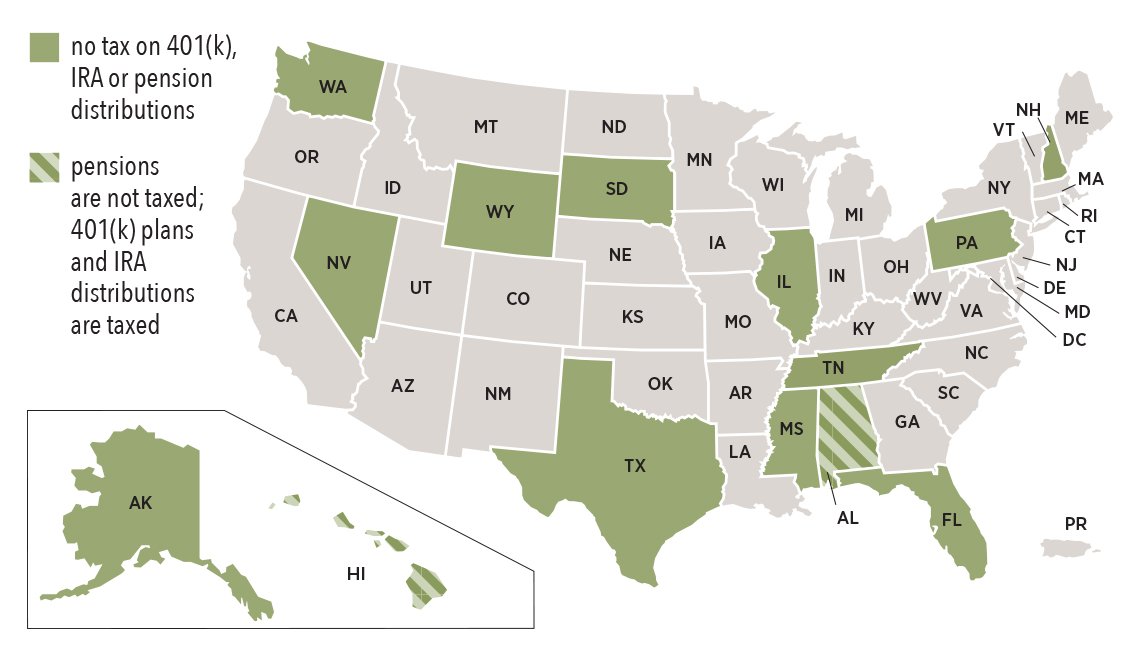

States That Don't Tax Income

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming

States That Don't Tax Retirement Distributions

Tax Planning Documents

taxes folder for the year

collect all related tax documents ( taxes paid, w2 forms, 1099 forms etc )

create a year folder for the tax years documents

software folder for tools - reformat fmr net gains csv for each taxable account or use txf tool to reformat taxable net gains

C:\Users\Jim Mason\Google Drive\_save\Finance\taxes txf_added-notes.txt

see _my_financial management and taxes.docx

D:\dsfw\apps\hrblock for year tax software and year-data

C:\Users\Jim Mason\Google Drive\_save\Finance\tools\txf_creator

Tasks to prepare for Tax returns

- get hrblock software for the year

- update hrblock software - HRBlock2019.exe - Shortcut ( online or manual download of updates )

- For capital gains TXF data - see these 3 options ( Option 1 should work well )

- Option 1 - edit the Fidelity csv file to get the selected columns and headings needed for the TXF format 4 record below

if that fails due to bad Fidelity csv format - Option 2 - use a custom Groovy pgm to create taxable net gains from fin svcs ( like Fidelity )

- view the Fidelity tax form csv data does not have the symbol for the cusip

- must construct symbol in groovy app as csv from this description

PUT BAC $34 EXP 05/21/2021 BAC210521 5014619BZ

BAC21051P34

- must construct symbol in groovy app as csv from this description

- query closed positions for the year under each account does not have the acquire and sale dates

- GROOVY pgm to read fmr tax csv and generate the txf csv fmt

Symbol,Quantity,Date Acquired,Cost,Date Sold,Proceeds,Gain

- view the Fidelity tax form csv data does not have the symbol for the cusip

- use HR Block import financial data first based on your Fidelity login credentials

if that fails - Option 3 - use Fidelity ATP to create a csv file with the right columns for net gains

- use Fidelity ATP to get the financial net gains and download as an .xls file

- ATP > accounts > select account > select close positions > select period > view table > expand EVERY trade for lots > RB menu > export to xls

- optional — use groovy to create lot level details for every trade in TXF input format OR just assign default dates to summary lines based on CAP gain as LT or ST

columns for TXF input file - TXFCreator only reads up to "Gain" column – rest is to automatically set dates using ST or LT gain info

Symbol Quantity Date Acquired Basis Date Sold Proceeds Gain Short-Term G/L Long-Term G/L Basis/Share Proceeds/Share - use txf software to convert net gains csv to file.txf format

- get credit card, bank details as csv files for the year and categorize by expense type

- load last year's returns after starting a new return

- get last year's tax payments, refunds

- get last year's taxes paid ( property tax etc )

i>> HR Block forms don't allow paste - look at AHK for Windows or ?? for Linux

AHK for Windows to paste to HR Block forms

https://www.bogleheads.org/forum/viewtopic.php?t=319687

AHK for Linux to paste to HR Block forms >> none that can work with HR Block

Task - Convert taxable net gains csv file to TXF format

TXF File formats defined - use format 4 for stock sales

https://taxdataexchange.org/docs/txf/v042/index.html

use terminal on cd Google drive to run TXF creator in Windows ( run.bat ) or Linux ( run.sh )

C:\Users\Jim Mason\Google Drive\_save\finance\taxes

from shell on macos at home >> cd

/Volumes/GoogleDrive/'My Drive'/_save/finance/taxes

see more details on TXF in _tax-notes2.txt

//=======================================

x140 ATP history reported

select only buy sell transactions

select only closed orders

shows gain / loss query by closed order with dates

use to create csv or xls for download to edit

after edit, export csv in matching format for txf-express tool

//=======================================

x150 txf conversion from fidelity csv

Double click the txf-creator.jar file to launch TXF Creator.

**********************************************************************

TXF Creator (Version 4.0) README.TXT

Copyright (c) 2008 TXF Express LLC December 2008

TXF Creator is a software product developed by TXF Express LLC, which

allows a user to convert stock trades from multiple brokerage accounts

to TXF (Trade eXchange Format) files with just a few clicks of the

mouse. The user can import stock trades into any tax software program

that accepts TXF such as TurboTax and TaxCut.

github txf oss tool

https://github.com/andreasg123/stock-gain-tax-import/issues/1

OR

run free online conversion

this worked for load in 2017 to hr block with valid csv file

-------------------------------------------

get the net gain csv file from Fidelity

OLD >> use ATP custom query on closed transactions for the year-on-year

export as csv

NEW >> download the 1099 csv file from accounts > tax information > 1099 forms > csv files for each account's

-------------------------------------------

Convert a net gain csv file in workbook

Option 1 NEW >> use libre office calc to convert to csv from 1099 formating

remove all but detail records

remove unneed columns

create gain column as sum of cost, proceeds columns

rearrange columns to meet txf format above

save as csv file

-------------------------------------------

FORMAT FOR TXF CSV file

Your CSV file should have ONLY the following six (6) columns in this EXACT order

(headers are optional):

Symbol Quantity Date Acquired Cost Date Sold Proceeds Gain

AAPL 100 10/01/2015 $21895.50 11/15/2015 30125.25 8170.25

Option 2 OLD >> - parse with groovy

jim-tax-symbol-parse.groovy

Free Online TXF file generator

Get Started

Follow these steps:

Click Choose CSV File to pick your .CSV file to upload

Click Convert and if prompted select "save to file".

Import the downloaded TXF file in TurboTax.

Your CSV file should have ONLY the following six (6) columns in this EXACT order

(headers are optional):

Symbol Quantity Opening Date Opening Net Amount Closing Date Closing Net Amount

AAPL 100 10/01/2018 $21895.50 11/15/2018 30125.25

Important: Make sure you save as a CSV file with a .csv file extension. You can use Excel , Google Sheets or OpenOffice to rearrange columns if needed and save as a new .csv file.

Key Concepts

Tax Planning

Retirement RMD rules

tax-RMD-2021-rule-changes-This retirement rule will be back with a vengeance in 2021.pdf gdrive

No RMD in 2020

RMD required in 2021 from all retirement accounts

RMD options

- Withdrawals that rollover to IRA - pay taxes separately to role the full amount

- Plan Withdrawal to MAYBE use a larger amount IF the tax bracket max is NOT hit

- Plan Roth conversions given the risk that Roth conversions may be eliminated by Congress in 2022

- Rollover 401k to IRA - sets up for a Roth IRA conversion

- IRA to Roth IRA - taxable event

Purchase deferred annuity to reduce current income

Another way to reduce RMDs is by buying a deferred income annuity. You can invest up to 25% of your IRA or 401(k) account (or $135,000, whichever is less) in a type of deferred income annuity known as a qualified longevity annuity contract (QLAC). When you reach a specified age, which can be as late as 85, the insurance company turns your deposit into payments that are guaranteed to last the rest of your life

The portion of savings used for the annuity is excluded from the calculation to determine your RMDs. For example, if you have $500,000 in an IRA and transfer $100,000 into a QLAC, your RMD is based only on the remaining $400,000. This doesn’t eliminate your tax bill—it just defers it. The taxable portion of the money you invested will be taxed when you start receiving income from the annuity.

QLACs offer other advantages to retirees who want guaranteed income later in life. Because you’re deferring the income stream, payouts are much higher for deferred income annuities than they are for immediate annuities, which start payouts right away. For example, a 65-year-old man who invests $100,000 in an immediate annuity will receive a payout of $493 a month, according to www.immediateannuities.com. That same amount invested in a deferred-income annuity that begins payments at age 80 would pay $1,663 a month.

define options for accumulation period, investment guaranteed minimum returns, principal return to beneficiaries etc

Potential Value Opportunities

Earned Income Tax Credit for low to moderate wage earners

https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit-eitc

If qualified, can actually pay money after removing your tax liability based on income levels

Child Care Tax Credit

A credit on taxes for children you care for

Potential Challenges

Candidate Solutions

Step-by-step guide for Example

sample code block