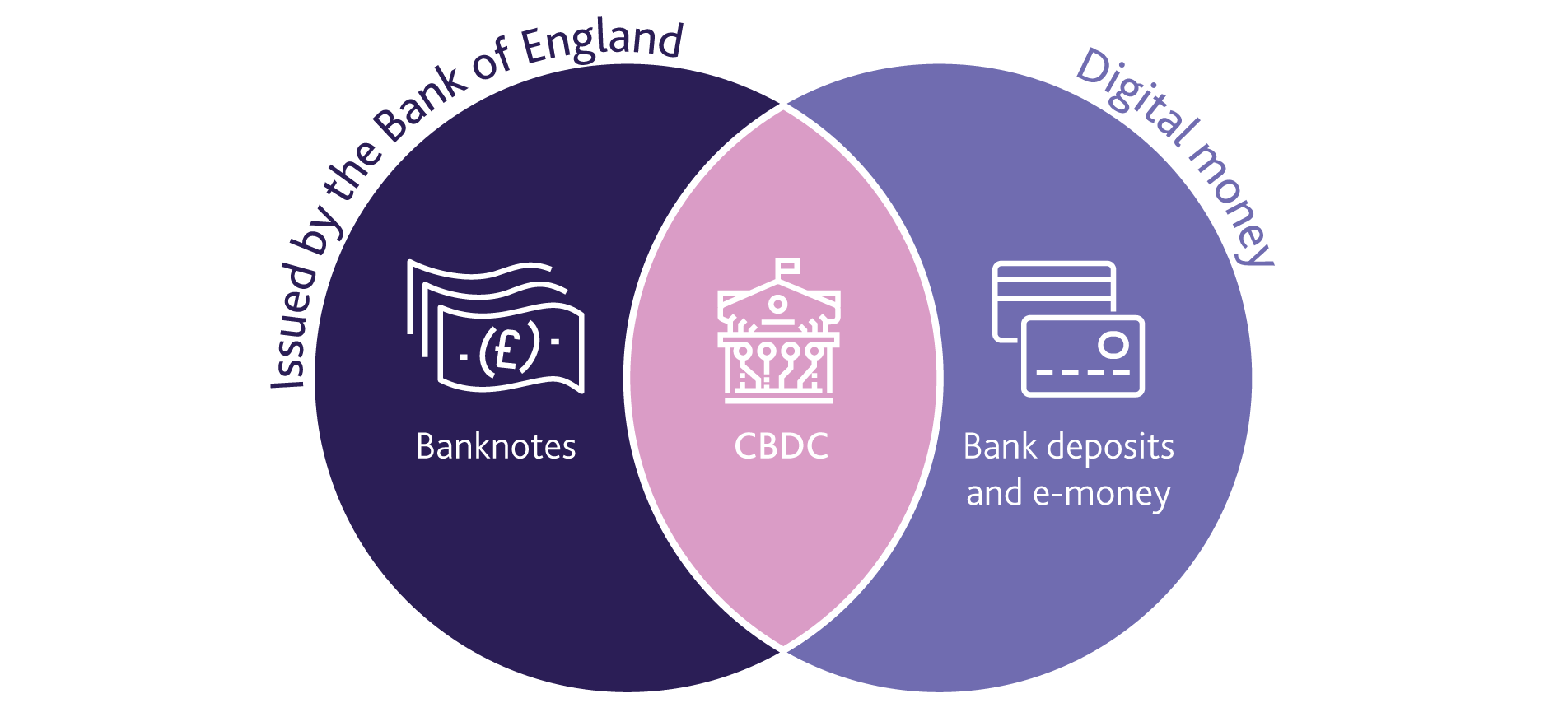

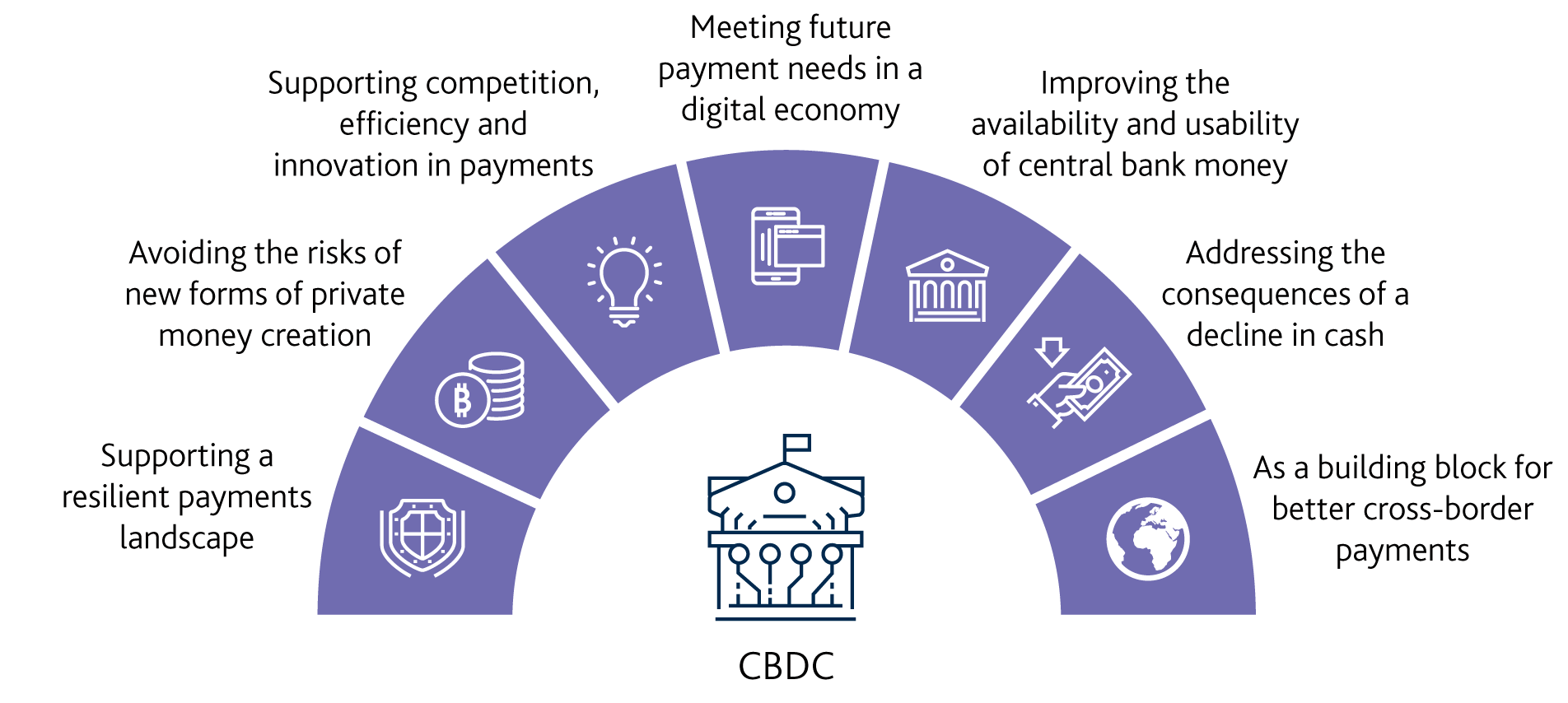

A Central Bank Digital Currency (CBDC) would be an electronic form of central bank money that could be used by households and businesses to make payments. The Bank has not yet made a decision on whether to introduce CBDC, and intends to engage widely with stakeholders on the benefits, risks and practicalities of doing so.

m Digital Currency and CBDC

Key Points

- Bitcoin is a value store not a value transfer

- While Bitcoin and similar cryptos will always have a market they are not the future of monetary systems

- Layer 2 networks won't scale any currency using POW to a level high enough for larger commercial networks

- CBDC - Central Bank Digital Currency model from China may become a key currency for trading and, eventually, reserve status

- US won't win long-term trade and currency disputes with China but short-term agreements should improve trade again

- CBDC projects by multiple Central Banks are moving forward with clearly defined use cases prior to rollout reducing risks

- Future monetary systems need better collaboration on platforms, regulations, economics and governance that go beyond simple DLT smart contracts

- Stablecoins have more risk but big banks are starting to issue them: JP Morgan etc

This is a summary of some key CBDC use cases including security settlements. An effective, future monetary system needs redesigned platforms, regulations, economics and governance. There's a lot of work to cover here. We'll continue to track these CBDC use cases and pilot efforts in the Hyperledger Public Sector Group https://wiki.hyperledger.org/display/PSSIG.

References

CBDC use case Concepts

ISSA study on CBDC for Post-Trade Settlement - 2021

ISSA on Blueprint for CBDC in post-trade settlement link

ISSA-Blueprint-CBDC-in-Post-Trade-Settlement-December-2021-FINAL.pdf file

CBDC and SC offers potential advantages over today’s settlement methods. This is particularly apt when discussing the settlement of securities on DLT, as the simultaneous exchange of CBDC/SC and securities tokens (aka atomic settlement) is a key attribute of a DLT solution and the creation of a Delivery versus Payment DvP

this blueprint which will outline the roles (including the possible changes of current roles), challenges, opportunities and potential changes that the impact of CBDC & SC could have on the banking, fintech, and securities industry.

The use of CBDC can provide several benefits including:

- a. faster settlement finality

- b. liquidity and integrity2

- c. atomic settlement

- d. reduced operational work to reconcile between many different systems (including the possibility of aligning securities and cash on a single platform)

- e. programmability (e.g., to detect and call out on the potential of systemic liquidity gridlock,…etc)

- f. process and responsibility changes to reduce risk and increase efficiency

The use of CBDC may also present new risks for the ecosystem.

To maintain the benefits of true DvP1 settlement in central bank money, it is logical to conclude that a CBDC using DLT as the underlying technology would be an enabler for this.

A French paper on CBDC settlement for bond trades concludes:

“.. the full value of blockchain cannot be realized by simply replicating ‘as is’ the securities settlement operations processes. ... enabling direct access by end investors on the blockchain platform via their custodians and/or removing the current post trade processing breaks, would allow blockchain technology to significantly improve post-trade operations. This could then remove reconciliation processes, reduce the overall cost and increase the efficiency of the capital markets.”

Jim>> this new DLT model introduces new scaling, governance and risk challenges while also reducing the need for some current reconciliation and netting processes

Keys for success with CBDC for post trade settlements:

- token standardisation

- designed for interoperability

- programmability

- designed for fast adoption (be that open source, using existing infrastructure and existing platforms, or other solutions)

- ability to auto-convert between CBDC in the currency of choice; i.e., not a “global” coin, but convertible coins

it is imperative that CBDC solutions are designed to be interoperable.

This means interoperable not only between CBDCs, but also between existing securities platforms and ecosystems, since a period of co-existence is likely.

the potential implementation of CBDC using DLT as the underlying technology within the wholesale securities markets will become the catalyst for the development of DLT adoption in securities ecosystems.

Stable coins are not well regulated or mature but underpin existing DeFi systems

To be genuinely useful, SC need to be regulated and offer both consumer protection and financial stability: i.e., be a store of value which is easily convertible. As yet, the regulation for SC is at an immature state, but that has not prevented a number of SC underpinning the Decentralised Finance (DeFi) environment

Jim>> central banks will issue CBDCs but it won't impact securities settlement until a global marketplace evolves with interoperability, low-cost transactions and currency conversions

Governance issues to resolve include:

- Interoperability extends to cross-border legal and regulatory compatibility where jurisdictions consider how domestic laws and regulations view and treat foreign CBDC

- AML / CFT / KYC requirements: digital ID is a rising issue in certain jurisdictions and will aid in meeting AML / CFT / KYC requirements.

- Digital ID may also be central to the design and controls of a CBDC

- Privacy and data protection

- Currency controls, tax law, property law, securities and payment regulations

Executive Order on Ensuring Responsible Development of Digital Assets - 220309

We must take strong steps to reduce the risks that digital assets could pose to consumers, investors, and business protections; financial stability and financial system integrity; combating and preventing crime and illicit finance; national security; the ability to exercise human rights; financial inclusion and equity; and climate change and pollution.

Objectives

ensure safeguards for responsible development of digital assets to protect consumers

ensure that safeguards are in place and promote the responsible development of digital assets to protect consumers, investors, and businesses; maintain privacy; and shield against arbitrary or unlawful surveillance, which can contribute to human rights abuses.

controls to mitigate illicit finance reducing market and national security risks similar to existing financial solutions

Digital asset issuers, exchanges and trading platforms, and intermediaries whose activities may increase risks to financial stability, should, as appropriate, be subject to and in compliance with regulatory and supervisory standards that govern traditional market infrastructures and financial firms, in line with the general principle of “same business, same risks, same rules.”

Growth in decentralized financial ecosystems, peer-to-peer payment activity, and obscured blockchain ledgers without controls to mitigate illicit finance could also present additional market and national security risks in the future. The United States must ensure appropriate controls and accountability for current and future digital assets systems to promote high standards for transparency, privacy, and security — including through regulatory, governance, and technological measures — that counter illicit activities and preserve or enhance the efficacy of our national security tools

sustain United States financial power and promote United States economic interests.

We must reinforce United States leadership in the global financial system and in technological and economic competitiveness, including through the responsible development of payment innovations and digital assets. Continued United States leadership in the global financial system will sustain United States financial power and promote United States economic interests.

help underserved communities with greater low cost access to financial products and services

The United States has a strong interest in promoting responsible innovation that expands equitable access to financial services, particularly for those Americans underserved by the traditional banking system, including by making investments and domestic and cross-border funds transfers and payments cheaper, faster, and safer, and by promoting greater and more cost-efficient access to financial products and services.

reduce climate impacts and illicit activities in digital asset systems

The United States has an interest in ensuring that digital asset technologies and the digital payments ecosystem are developed, designed, and implemented in a responsible manner that includes privacy and security in their architecture, integrates features and controls that defend against illicit exploitation, and reduces negative climate impacts and environmental pollution, as may result from some cryptocurrency mining.

Coordination

The Assistant to the President for National Security Affairs (APNSA) and the Assistant to the President for Economic Policy (APEP) shall coordinate, through the interagency process described in National Security Memorandum 2 of February 4, 2021 (Renewing the National Security Council System), the executive branch actions necessary to implement this order.

Policy and Actions Related to United States Central Bank Digital Currencies.

My Administration places the highest urgency on research and development efforts into the potential design and deployment options of a United States CBDC.

My Administration sees merit in showcasing United States leadership and participation in international fora related to CBDCs and in multi‑country conversations and pilot projects involving CBDCs.

We should prioritize timely assessments of potential benefits and risks under various ( CBDC ) designs to ensure that the United States remains a leader in the international financial system

CBDC report required in 180 days from 3/9/22

Based on the potential United States CBDC design options, this report shall include an analysis of:

(i) the potential implications of a United States CBDC, based on the possible design choices, for national interests, including implications for economic growth and stability;

(ii) the potential implications a United States CBDC might have on financial inclusion;

(iii) the potential relationship between a CBDC and private sector-administered digital assets;

(iv) the future of sovereign and privately produced money globally and implications for our financial system and democracy;

(v) the extent to which foreign CBDCs could displace existing currencies and alter the payment system in ways that could undermine United States financial centrality;

(vi) the potential implications for national security and financial crime, including an analysis of illicit financing risks, sanctions risks, other law enforcement and national security interests, and implications for human rights; and

(vii) an assessment of the effects that the growth of foreign CBDCs may have on United States interests generally.

continue to research and report on the extent to which CBDCs could improve the efficiency and reduce the costs of existing and future payments systems,

The Attorney General shall:

(i) within 180 days of the date of this order, provide an assessment of whether legislative changes would be necessary to issue a United States CBDC

(ii) within 210 days of the date of this order, provide a legislative proposal

Measures to Protect Consumers, Investors, and Businesses

It is critical to ensure that digital assets do not pose undue risks to consumers, investors, or businesses, and to put in place protections as a part of efforts to expand access to safe and affordable financial services.

submit a report on the implications of developments and adoption of digital assets and changes in financial market and payment system infrastructures for United States consumers, investors, businesses, and for equitable economic growth. identify conditions that would drive mass adoption of different types of digital assets and the risks and opportunities such growth might present to United States consumers, investors, and businesses, including a focus on how technological innovation may impact these efforts and with an eye toward those most vulnerable to disparate impacts. The report shall also include policy recommendations, including potential regulatory and legislative actions,

submit a technical evaluation of the technological infrastructure, capacity, and expertise that would be necessary at relevant agencies to facilitate and support the introduction of a CBDC system

submit a report on the role of law enforcement agencies in detecting, investigating, and prosecuting criminal activity related to digital assets. The report shall include any recommendations on regulatory or legislative actions, as appropriate.

consider what, if any, effects the growth of digital assets could have on competition policy.

consider the extent to which privacy or consumer protection measures may be used to protect users of digital assets and whether additional measures may be needed

consider the extent to which investor and market protection measures may be used to address the risks of digital assets and whether additional measures may be needed.

submit a report to the President on the connections between distributed ledger technology and short-, medium-, and long-term economic and energy transitions and address:

(A) potential uses of blockchain that could support monitoring or mitigating technologies to climate impacts, such as exchanging of liabilities for greenhouse gas and

(B) implications for energy policy, including as it relates to grid management and reliability, energy efficiency incentives and standards, and sources of energy supply.

Actions to Promote Financial Stability, Mitigate Systemic Risk, and Strengthen Market Integrity

The United States must assess and take steps to address risks that digital assets pose to financial stability and financial market integrity.

produce a report outlining the specific financial stability risks and regulatory gaps posed by various types of digital assets and providing recommendations to address such risks.

Actions to Limit Illicit Finance and Associated National Security Risks.

need for ongoing scrutiny of the use of digital assets, the extent to which technological innovation may impact such activities, and exploration of opportunities to mitigate these risks through regulation, supervision, public‑private engagement, oversight, and law enforcement

submit additional views on illicit finance risks posed by digital assets, including cryptocurrencies, stablecoins, CBDCs, and trends in the use of digital assets by illicit actors

develop a coordinated action plan based on conclusions for mitigating the digital‑asset-related illicit finance and national security risks addressed in the updated strategy.

notify ( other agencies ) on any pending, proposed, or prospective rule makings to address digital asset illicit finance risks

Policy and Actions Related to Fostering International Cooperation and United States Competitiveness.

There must also be cooperation to reduce inefficiencies in international funds transfer and payment systems.

The United States must continue to work with international partners on standards for the development and appropriate interoperability of digital payment architectures and CBDCs to reduce payment inefficiencies and ensure that any new funds transfer and payment systems are consistent with United States values and legal requirements

the United States established the G7 Digital Payments Experts Group to discuss CBDCs, stablecoins, and other digital payment issues. While a CBDC would be issued by a country’s central bank, the supporting infrastructure could involve both public and private participants

Such international work should continue to address the full spectrum of issues and challenges raised by digital assets, including financial stability, consumer, investor, and business risks, and money laundering, terrorist financing, proliferation financing, sanctions evasion, and other illicit activities.

My Administration will elevate the importance of these topics and expand engagement with our critical international partners, including through fora such as the G7, G20, FATF, and FSB. ... to ensure that our core democratic values are respected; consumers, investors, and businesses are protected; appropriate global financial system connectivity and platform and architecture interoperability are preserved; and the safety and soundness of the global financial system and international monetary system are maintained

establish a framework for interagency international engagement with foreign counterparts and in international fora to, as appropriate, adapt, update, and enhance adoption of global principles and standards for how digital assets are used and transacted, and to promote development of digital asset and CBDC technologies consistent with our values and legal requirement

submit a report to the President on priority actions taken under the framework and its effectiveness

establish a framework for enhancing United States economic competitiveness in, and leveraging of, digital asset technologies

submit a report to the President on how to strengthen international law enforcement cooperation for detecting, investigating, and prosecuting criminal activity related to digital assets.

Definitions. For the purposes of this order:

(a) The term “blockchain” refers to distributed ledger technologies where data is shared across a network that creates a digital ledger of verified transactions or information among network participants and the data are typically linked using cryptography to maintain the integrity of the ledger and execute other functions, including transfer of ownership or value.

(b) The term “central bank digital currency” or “CBDC” refers to a form of digital money or monetary value, denominated in the national unit of account, that is a direct liability of the central bank.

(c) The term “cryptocurrencies” refers to a digital asset, which may be a medium of exchange, for which generation or ownership records are supported through a distributed ledger technology that relies on cryptography, such as a blockchain.

(d) The term “digital assets” refers to all CBDCs, regardless of the technology used, and to other representations of value, financial assets and instruments, or claims that are used to make payments or investments, or to transmit or exchange funds or the equivalent thereof, that are issued or represented in digital form through the use of distributed ledger technology. For example, digital assets include cryptocurrencies, stablecoins, and CBDCs. Regardless of the label used, a digital asset may be, among other things, a security, a commodity, a derivative, or other financial product. Digital assets may be exchanged across digital asset trading platforms, including centralized and decentralized finance platforms, or through peer-to-peer technologies.

(e) The term “stablecoins” refers to a category of cryptocurrencies with mechanisms that are aimed at maintaining a stable value, such as by pegging the value of the coin to a specific currency, asset, or pool of assets or by algorithmically controlling supply in response to changes in demand in order to stabilize value.

Reactions to the Executive Action on Digital Assets

Banks partner with Custodial Banks to manage Digital Assets - 2022

Key Questions to Ask on the US Executive Order

Objectives potential

- What are the key objectives?

- Which ones are likely to be met first?

- Which ones are NOT likely to be met soon?

CBDC

- If the CBDC tasks are completed, what's the likely result?

- What CBDC laws should be enacted to protect consumers?

- What laws exist to protect consumers with fiat currency?

- Are current digital infrastructures adequate for CBDC security?

- How would infrastructure involve both public and private participants for CBDC?

- What views on illicit finance risks posed by digital assets, crypto CBDCs, by illicit actors will be reported?

- For the US citizens, will these regulations and CBDC hurt or help Bitcoin?

- what does the principle of “same business, same risks, same rules.” for digital asses mean?

International cooperation and competitiveness

- will this reduce inefficiencies in international funds transfer and payment systems?

- Thoughts on "a framework for international engagement with foreign counterparts to enhance adoption of global standards for how digital assets are used and transacted"?

Expected legislation

- Will blockchain be used to monitor economic and energy impacts?

- what is the implication for climate change on digital assets?

- what regulatory gaps posed by digital assets need to be managed?

- What is needed to reduce illicit finance and security risks?

Impacts on financial services

- What is the expected impact on DEFI solutions from this program?

- What is the expected impact on CEFI solutions from this program?

- Will the US monitor financial transactions more than it does now?

- Will the unbanked prefer to remain unbanked?

- How will US encourage unbanked to move to digital financial systems and governance?

- What is the expected impact for US middle class on financial services costs going forward?

Thoughts on Executive Order on Digital Asset Management and Regulation

Remember the pandemic and the pressure OVERNIGHT that hit the pharmaceutical companies to invent and rollout tests, vaccines and therapies for Covid?

This executive order just did that for digital assets management.

The DeFi Opportunity for the Digital Asset program - DeFi has been disrupted, needs reinvention

What you see now is the new DeFi companies are now disrupted. They need to move to Class A controls, governance, compliance, security, resiliency as SIFMU organizations. A small but increasing group of DeFi organizations have made this a priority to follow regulations and are moving in that direction now.

The CeFi Opportunity for the Digital Asset program - CeFi needs fast, coordinated innovation, efficient delivery for all

The Traditional Finance companies also have pressure to expand their strong governance controls to deliver more efficient, low-risk, affordable, inclusive services adapted for digital assets and integration with other digital asset providers.

CeFi providers should offer to participate where possible with Federal agencies in the assessment and planning reports to ensure a valuable CBDC program and mitigation of risks ensuring the objectives of the Executive Action are met

Read Between the Lines

The ideas that follow are mine alone and do not represent any organization or authority.

Some potentially large amount of these will turn out to be totally wrong.

The US government can change their goals, plans at anytime invalidating these ideas.

- The key objectives

- ensure safeguards for responsible development of digital assets to protect consumers

- controls to mitigate illicit finance reducing market and national security risks similar to existing financial solutions

- sustain United States financial power and promote United States economic interests.

- help underserved communities with greater low cost access to financial products and services.

- reduce climate impacts and illicit activities in digital asset systems

- ensure safeguards for responsible development of digital assets to protect consumers

- Going from the EA order to implementation will take years

While the required reports are due between 90 days and 1 year, many actions will require legislative approval which will add at least another year.

As a result, full implementation can't happen before 2024 - Federal control of all financial assets & markets

Measures proposed ( for the reasons noted ) in the Executive Action drive toward full central control and governance of all digital assets in line with other financial assets. Under the US Constitution, States controlled banking and voting regulations except where superseded by Federal Law. The erosion of state controls continues - Keep USD as the world reserve currency

"Continued United States leadership in the global financial system will sustain United States financial power and promote United States economic interests."

Assumes US should stay in charge of the World's financial systems and reserve currency even though we are not early in managing digital assets compared to other countries. China has spent 20+ years working to remove USD as the single reserve currency with limited success so far. Tracking foreign purchases of US debt every month at Fed auctions will show if US is losing our primary reserve currency role. This is a big issue for US long term economic health.

US actions on seizing Russian assets over Ukraine invasion has created the largest public threat to the USD role as the reserve currency ( see article ). It's likely the USD role as the world's reserve currency will decrease ( a threat identified back in 2006 ). - Improve financial system inclusion for underserved

A few core principles of DeFi on financial inclusion are a strong focus on the required outcomes for this program. DeFi has strong goals but limited success on these goals so far due to a variety of factors. - DeFi disrupted - should be regulated similar to CeFi

"Digital asset issuers, exchanges and intermediaries should be subject to regulatory and supervisory standards that govern traditional market infrastructures and financial firms, in line with the general principle of “same business, same risks, same rules.”

Most of the required outcomes focus on governance, control, compliance, regulatory and consumer transparency are similar to many CeFi solutions for governance.

DeFi will operate and compete with CeFi under the same rules. Both can update to new technologies. - Digital Asset management now is considered SIFMU services with hardened security, resiliency.

Systemically Important Financial Market Utilities – special responsibilities under US law for key banks, markets etc - A more secure Federal Identity program using SSI technology

with the comparable system protections and recovery Social Security offers will be key for financial system inclusion and security

Traditional central identity and federated identities ( login with your twitter id ) are much higher risk - Coordination of standards and regulations with other countries, particularly EU, is key

Standards on many of the technologies are generally not agreed to yet. Concepts and best practices have some limited consensus technically.

Getting agreement on financial regulations across key countries is never simple but always important ( KYC, AML etc ) - The Executive Action hints strongly at the desired outcomes for many of the issues. Bitcoin does not align well as part of a CBDC ecosystem compared to other currencies.

US Commerce Department Issues RFC on Digital Asset Technologies

https://www.govinfo.gov/content/pkg/FR-2022-05-19/pdf/2022-10731.pdf

Gina Raimondo, Secretary of Commerce, issued an RFC ( Request for Comment ) on the development of a framework to enhance US economic competitiveness to comply with the President's directive ‘‘Ensuring Responsible Development of Digital Assets’’ to leverage digital assets in government.

US Treasury on more regulation and oversight for cryptocurrencies - 220916

https://finance.yahoo.com/news/treasury-crypto-regulation-reports-september-100041563.html

The U.S. Treasury is warning in three new reports that cryptocurrencies pose meaningful risks for consumers, investors, and businesses if not properly regulated.

The government is also recommended moving forward with work on a central bank digital currency, but stopped short of recommending one.

The reports encourage the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) to “aggressively” pursue investigations and enforcement actions against crypto companies that aren’t in compliance with laws.

Treasury also urges the Consumer Financial Protection Bureau (CFPB) and Federal Trade Commission (FTC) to double down on efforts to monitor consumer complaints and to enforce against unfair, deceptive, or abusive practices.

“At the same time, if these risks are mitigated, digital assets and other emerging technologies could offer significant opportunities,” said Treasury Secretary Janet Yellen.

Better governance and transparency are key

One of the reports contends customers were regularly mislead about crypto’s features and expected returns, and that non-compliance with regulations is widespread. One study found nearly a quarter of digital coin offerings had disclosure or transparency issues, including plagiarized documents or false promises of guaranteed returns.

CBDC support building in US Government agencies as expected from the March Executive Action on Digital Assets

The second of Treasury's three reports recommends moving forward with work on a CBDC, or central bank digital currency, in case it’s determined to be in the national interest. While no decisions have been made to issue a CBDC, the report is meant to help policymakers understand the technical design choices of a CBDC system.

“Consistent with the President’s directive to place the 'highest urgency' on research and development of a U.S. central bank digital currency, the Administration encourages the Federal Reserve to continue its research and experimentation,” NEC Director Brian Deese said in a statement.

Deese said the White House also launched an interagency working group, including the National Security Council and Treasury, to support the Fed’s efforts by the considering policy implications of a potential CBDC, especially for our national security. The group will meet regularly to discuss updates and progress.

Treasury says a CBDC would be considered legal tender and would be convertible one-for-one into reserve balances or paper currency.

Congress House Reports on Digital Asset Regulation

House Financial Services Committee Reports Digital Asset Market Structure, National Security Legislation to Full House for Consideration

Press Releases

| |||||||||||

Recommended Activities

Hyperledger Public Sector Program

EU Blockchain Forum

GBA

ATARC

Liz Tanner and RI on SSI for CBDC

Interviews with selected parties

Article for Forbes or ?

Other options to a FED CBDC for US digital currency

https://cointelegraph.com/news/fitting-the-bill-us-congress-eyes-e-cash-as-an-alternative-to-cbdc

States with Digital Asset Orders or Legislation

https://pro.bloomberglaw.com/brief/cryptocurrency-laws-and-regulations-by-state/

State-laws-crypto-2022-march-pro.bloomberglaw.com-Cryptocurrency Laws and Regulations by State.pdf file

Wyoming

Rhode Island

https://legiscan.com/gaits/search?state=RI&keyword=blockchain

economic growth blockchain act, set regulations for the sale of hemp, regulate virtual and digital assets, and establish depository banks for these purposes.

https://legiscan.com/RI/bill/H7254/2022

develop and 28 implement a blockchain filing system specific only to record council actions

review of blockchain and related technology,

hemp - ( alcohol ? ) - establish a track and trace program for reporting the movement of regulated 10 products.

Establish procedures for the incorporation, chartering and operation of special purpose depository institutions;

analysis >> https://cointelegraph.com/news/rhode-island-introduces-vital-blockchain-growth-act

RI currency transmission law - DBR - FAQS

Yes. Cryptocurrency wallets (and the like) squarely fall within the definition of “maintaining control of virtual currency” “on behalf of others” when the business has custody of funds in the wallets. § 19-14-1(4)(ii).

RI currency transmission licensure would NOT be required for a business that sells or buys VC in customer transactions in exchange for fiat consideration.

The definition of “virtual currency” EXCLUDES online game tokens,

article - RI requires license for virtual currency transactions in most cases

https://www.jdsupra.com/legalnews/rhode-island-requires-licensure-for-80512/

RI crypto rewards for green home builders act

https://cointelegraph.com/news/rhode-island-proposes-crypto-rewards-for-green-home-builders

If the project has been able to reduce its utility costs, the state will award a cryptocurrency credit to the property owner.

The newly proposed bill is meant to stimulate new housing developments in the state that suffers from a housing shortage exacerbated by increased prices year-on-year

RI Blockchain Legislation status - 2019

https://freemanlaw.com/cryptocurrency/rhode-island-blockchain-legislation-status-2/

New Hampshire

California

https://www.cnbc.com/2022/05/04/california-governor-signs-executive-order-on-cryptocurrencies.html

CBDC project tracker with filters url

CBDC projects in development using DLT in 2023

Trade and USD reserve currency

US not prepared for the economic sanctions on Russia - 220423

As Fortress Russia crumbles, the global economy faces a new world order

https://news.yahoo.com/fortress-russia-crumbles-global-economy-082411869.html

The trade impacts are not hard to forecast for most of us including those in government.

The long-term hit to the US dollar as the World's primary reserve currency was missed.

Some in global finance, including the International Monetary Fund, fear the onslaught of Western sanctions means the global economy is splitting into camps in the wake of Russia’s invasion, one led by the US and the other by China, with disastrous consequences.

They believe the world economy is fracturing into two parts. Russia will be forced to move away from Western finance, tech and the US dollar, perhaps into Chinese President Xi Jinping’s arms, while others could follow to avoid being next.

“The war also increases the risk of a more permanent fragmentation of the world economy into geopolitical blocks with distinct technology standards, cross-border payment systems, and reserve currencies,” IMF chief economist Pierre-Olivier Gourinchas said last week as he delivered a grim set of global economic forecasts in the wake of the invasion of Ukraine.

He said this “tectonic shift” where trade and standards separate into blocks would be a “disaster” for the global economy. It would be “a major challenge to the rules-based framework that has governed international and economic relations for the last 75 years”, Gourinchas added.

Most see a permanent shift away in the global economy and US dollar as reserver currency

While the big thinkers in economics appear to agree that a fundamental shift is underway in the global economy, they remain divided over what kind of post-Covid, post-Ukraine war world will emerge. Some believe the war will cause economic fragmentation and the demise of the dollar as the world’s reserve currency; others swat away the idea that such a seismic shift is underway.

“Some of these trends will be accelerated, particularly [given] you are drawing Russia, China, India and other countries closer together. They're starting to use the renminbi in bilateral trade instead of the dollar.”

Government-imposed financial sanctions taken against Russia by the West have been sweeping and devastating, while individual companies have delivered a blow by pulling their operations out of the country. There are worries this could force Russia and others to seek alternatives to a global financial system dominated by the West and its financial heavyweights.

the West targeted its lenders and central bank.

Once considered a “nuclear” option, a number of Russian banks were ejected from the Swift global payments messaging system, making it far harder for them to do business and make cross-border payments. Visa and Mastercard also suspended their operations in the country, blocking access to new cards issued by the payment giants.

Meanwhile, following the invasion, the West froze half of the Russian central bank’s foreign currency and gold reserves, hindering Moscow’s ability to prop up the rouble and its banking system.

Under Putin’s Fortress Russia plan to insulate it from sanctions, Moscow had built up a $640bn war chest of foreign reserves. The freezing of these reserves was considered a game-changing move, in an unexpected and powerful escalation of the financial siege on Russia. It prompted a plunge in the rouble and the introduction of capital controls in the country.

Some fear this weaponisation of finance and the US dollar has long-term consequences, perhaps luring countries to a new rival sphere headed by China.

Alternate financial systems grow in the East

Russian banks are turning to alternatives to the Belgium-based Swift in order to smooth cross-border payments. Its central bank has its own system it has already offered India for rouble payments, while China also has an alternative that could rival Swift.

Moscow’s lenders have turned to China’s payment giant UnionPay to help them issue debit and credit cards after Visa and Mastercard joined the mass exodus of Western brands from Russia. The two American payment heavyweights accounted for 70pc of the Russian debit card market but the Kremlin created its own system, Mir, following the Crimea annexation

Fears of a split have also rekindled the long-running debate over whether the US dollar is at risk of losing its status as the world’s reserve currency.

“After this war is over, ‘money’ will never be the same again,” said Zoltan Pozsar at Credit Suisse as he declared a “new world (monetary) order” following the freezing of the Russian central bank’s reserves.

Russia, however, claims several buyers have agreed to pay for its gas in roubles, while Saudi Arabia is reportedly considering accepting China’s currency instead of dollars for oil sales to Beijing amid tensions with Washington.

“This was a weapon that the US had been increasingly using,” says Perkins. “There's always been warnings going back at least a decade, saying ‘you can't keep doing this over and over again’ because eventually you get to a point where you change the status of the dollar. It’s just this is so high profile.”

He says there is now a “turning point”, but highlights that any move away from the dollar would be slow moving.

Prof Barry Eichengreen, an expert at University of California, Berkeley:

“The US was joined by the euro area, the UK, and Japan, among others, in imposing financial sanctions,” he says, adding that the Chinese renminbi is “an unattractive alternative to most countries”.

Trade is becoming more localized now slowly

Meanwhile Paul Donovan, chief economist of UBS Global Wealth Management, says the concept of a reserve currency will become less important as world trade “is likely to become less global over time”.

“If you are doing less global trade, then the importance of a global invoicing currency is less and central banks don't need to hold quite so much in foreign exchange reserves.”

He believes the global economy is not going through a splintering but a localisation effect where digitisation reduces the need for physical trade and production moves closer to consumers, such as clean energy over imported gas.

“A localisation process is something which doesn’t necessarily split the world into two, it splits the world into 196.”

Why US role as reserve currency matters

The US dollar has been dominant across the globe since the second world war, becoming the world’s reserve currency. This is the currency held most by central banks as part of foreign reserves and financial institutions to help facilitate global trade.

Countries, including China, have amassed almost $13 trillion in foreign reserves - around 60pc in dollars. As the sanctions on Russia have shown, however, those reserves could suddenly become useless if they are paralysed by the West.

Dollars have also been vital for global trade, being used for everything from invoicing in international business to buying commodities, such as oil.

Net takeaways on the Ukraine war and sanctions

Russia showed it can' be trusted as a military force

The US showed it can't be trusted as a financial force

Saudi Arabia deal with China shows the failure of US foreign policy again

The Ukraine war fits China's agenda. It wanted to move to an alternate financial system from the West. The US made that easy.

The US lost twice here: Russia conquers Ukraine ( more or all ) AND the US financial system declines rapidly as a force in the World Economy

A new alignment is growing moving forward

The West = North America, Europe, Japan, Australia, Israel

The East = China, Russia, North Korea, Iran

The Opportunists = India, Middle East, South America, Southeast Asia, Africa

The Opportunists are the key. If they all move West or East, that will tip the balance of power going forward

The threats from the East

- military expansion

- loss of freedom from democratic governments

- loss of West security guarantees

The benefits from the East

- social stability

- alternate reserve currency

- trade models built on commodities, agriculture, manufactured goods

- East security guarantees

US dollar is leading reserve currency now - issues

https://www.cfr.org/backgrounder/dollar-worlds-currency

The dollar’s status as the global reserve currency was cemented in the aftermath of World War II by the 1944 Bretton Woods Conference, in which forty-four countries agreed to the creation of the IMF and the World Bank. (Some economists have argued that the dollar had overtaken the British pound [PDF] as the leading reserve currency as early as the mid-1920s.) At Bretton Woods, a system of exchange rates was created wherein each country pegged the value of its currency to the dollar, which itself was convertible to gold at the rate of $35 per ounce. This was designed to provide stability, and prevent the “beggar-thy-neighbor” currency wars of the 1930s—a response to the Great Depression—by which countries abandoned the gold standard and devalued their currencies to try to gain a competitive advantage.

By 1973, the current system of mostly floating exchange rates was in place. Many countries still manage their exchange rates either by allowing them to fluctuate only within a certain range or by pegging the value of their currency to another, such as the dollar.

Factors that contribute to the dollar’s dominance include its stable value, the size of the U.S. economy, and the United States’ geopolitical heft.

Demand for US debt high, rates low as chief reserve currency

Over time, U.S. trade swung into a sustained deficit, supported in part by global demand for dollar reserves. Such demand helps the United States to issue bonds at a lower cost, since higher demand for a government’s bonds means it doesn’t have to pay as much interest to entice buyers, and helps to keep the cost of the United States’ now substantial external debt down.

US sanctions should be limited given reserve currency - “There’s no doubt that if the dollar were not so widely used, the reach of sanctions would be reduced,”

Consider favored nation trade status changes instead ??

Downside of reserve currency

A stronger currency makes imports cheaper and exports more expensive, which can hurt domestic industries that sell their goods abroad and lead to job losses. During times of economic turmoil, investors seek the safety of the dollar, which squeezes exporters at an already difficult time. “When there’s a big international role for your currency, you lose control over it,”

Countries can keep the value of its currency artificially low by accumulating dollar reserves, hurting U.S. exporters in the process improving their trade and payment balances with the US ( see China for decades )

US debt levels ( risk ) and interest rates ( return ) drive dollar demand as well

IMF SDR ( Special Drawing Rights ) - should it have a role in trade?

calls to use the IMF’s Special Drawing Rights (SDR) —an internal currency that can be exchanged for hard currency reserves—as a global reserve currency. The value of SDR is based on five currencies: the euro, pound sterling, renminbi, U.S. dollar, and yen. Proponents argue that such a system would be more stable than one based on a national currency whose issuer must respond to both domestic and international needs. The idea of using SDR was endorsed by the governor of China’s central bank, Zhou Xiaochuan, in 2009. Economists including Joseph Stiglitz have also supported a larger role for SDR.

But for SDR to be adopted widely, it would need to function more like an actual currency, accepted in private transactions with a market for SDR-denominated debt, Eichengreen writes. The IMF would also need to be empowered to control the supply of SDR, which, given the United States’ de facto veto power within the organization’s voting structure, would be a tall order.

Dollar Dominance and the Rise of Nontraditional Reserve Currencies

https://blogs.imf.org/2022/06/01/dollar-dominance-and-the-rise-of-nontraditional-reserve-currencies/

FED Study on US reserve currency status - 220706

https://finance.yahoo.com/news/nothing-horizon-rival-dollar-status-131852935.html

The dollar’s prime international status remains unchallenged, according a study by Federal Reserve Bank of New York staff, despite challenges from sources including geopolitics and technologies like digital currencies.

the study cites some factors that could erode the international use of the dollar over time.

Financial sanctions on Russia following its invasion of Ukraine could encourage de-dollarization by other countries anxious to avoid similar moves against them. And that could fragment the U.S. currency’s global role, the authors wrote.

Cryptocurrencies and central bank digital currencies could eventually supplant the dollar’s cross-border role in payments and investments

China moves to become a reserve currency

The U.S. dollar displaced the pound just as America gained economic superiority over Britain. More than 75% of global transactions have been completed in U.S. dollars since 2008. The dollar also accounts for more than 60% of foreign debt issuance and 59% of global central bank reserves.

Although the dollar’s grip on all these markets and instruments has been gradually declining in recent years, no other currency comes close to these levels. The Chinese renminbi certainly isn’t a viable alternative, but geopolitical and macroeconomic trends support its rise to dominance.

China’s plan

This year, Chinese leaders made it clear that they wanted to boost the renminbi’s profile as a reserve currency. China’s economy and trade flows are large enough to support such a move. However, the country now needs to convince foreign central bankers to start holding the Chinese Yuan (the principal unit of the renminbi) in reserve.

In July, The People's Bank of China announced a collaboration with five nations and the Bank for International Settlements to achieve this. China, along with Indonesia, Malaysia, Hong Kong, Singapore, and Chile would each contribute 15 billion yuan, about $2.2 billion, to the Renminbi Liquidity Arrangement.

Meanwhile, the Chinese Yuan has already become a de facto reserve currency in Russia. Russian leadership turned to China after facing sanctions from the West due to its invasion of Ukraine earlier this year. Now, 17% of Russia’s foreign reserves are denominated in yuan. The yuan is also the third most demanded currency on The Moscow Exchange.

As these partnerships become stronger, the yuan’s status as a reserve currency could be further entrenched.

China digital yuan has good soft launch

https://www.yahoo.com/finance/news/china-digital-currency-transaction-volume-041257245.html

The global impact

https://www.yahoo.com/finance/news/could-china-yuan-replace-u-194500498.html

The U.S. dollar displaced the pound just as America gained economic superiority over Britain. More than 75% of global transactions have been completed in U.S. dollars since 2008. The dollar also accounts for more than 60% of foreign debt issuance and 59% of global central bank reserves.

Although the dollar’s grip on all these markets and instruments has been gradually declining in recent years, no other currency comes close to these levels. The Chinese renminbi certainly isn’t a viable alternative, but geopolitical and macroeconomic trends support its rise to dominance.

China’s plan

This year, Chinese leaders made it clear that they wanted to boost the renminbi’s profile as a reserve currency. China’s economy and trade flows are large enough to support such a move. However, the country now needs to convince foreign central bankers to start holding the Chinese Yuan (the principal unit of the renminbi) in reserve.

In July, The People's Bank of China announced a collaboration with five nations and the Bank for International Settlements to achieve this. China, along with Indonesia, Malaysia, Hong Kong, Singapore, and Chile would each contribute 15 billion yuan, about $2.2 billion, to the Renminbi Liquidity Arrangement.

Meanwhile, the Chinese Yuan has already become a de facto reserve currency in Russia. Russian leadership turned to China after facing sanctions from the West due to its invasion of Ukraine earlier this year. Now, 17% of Russia’s foreign reserves are denominated in yuan. The yuan is also the third most demanded currency on The Moscow Exchange.

As these partnerships become stronger, the yuan’s status as a reserve currency could be further entrenched.

The global impact

Economists including Barry Eichengreen of the University of California Berkeley and Camille Macaire of France’s central bank published a paper analyzing the yuan’s potential as a reserve currency. The researchers argue that replacing the dollar isn’t going to be easy or quick. However, they found evidence that yuan reserves were steadily increasing in countries that had tighter trade relations with China.

This growing influence could make the yuan an alternative to the U.S. dollar in a “multipolar” world. In other words, China might chip away at the dollar’s influence over time. The study’s authors said the renminbi’s current position was similar to the U.S. dollar in the 1950s. Based on that comment, it could be just a few decades before the yuan gains parity.

If the forecasts are correct, long-term investors should consider some exposure to yuan-denominated assets and Chinese stocks with significant yuan earnings.

FED MIT OpenCBDC

Boston FED, MIT research on CBDC - 2022

https://news.mit.edu/2022/digital-currency-fed-boston-0203

MIT hamilton github architecture overview

Vipin's Forbes review of Hamilton CBDC project

Project Hamilton completed - 2022

the project focused on better understanding the capabilities and limitations of different technologies that might be used to manage and transfer CBDCs

OpenCBDC is a core processing engine for money that focuses on security, performance, scalability, and flexibility. It provides a codebase that supports 1.84 million transactions per second and settlement – meaning the transaction is completed – of under one second.

https://www.bostonfed.org/publications/one-time-pubs/project-hamilton-phase-1-executive-summary.aspx

By breaking transaction processing into steps like creation, authorization, submission, execution, and storing history, CBDC designers can consider the potential roles for intermediaries at each stage, creating opportunities for innovation.

The main functional difference between our two architectures is that one materializes an ordered history for all transactions, while the other does not. This highlights initial tradeoffs we found between scalability, privacy, and auditability. In the architecture that achieves 1.7M transactions per second, we do not keep a history of transactions nor do we use any cryptographic verification inside the core of the transaction processor to achieve auditability. Doing so in the future would help with security and resiliency but might impact performance.

Research topics may include cryptographic designs for privacy and auditability, programmability and smart contracts, offline payments, secure issuance and redemption, new use cases and access models, techniques for maintaining open access while protecting against denial of service attacks, and new tools for enacting policy.

OpenCBDC Github repo

https://github.com/mit-dci/opencbdc-tx

- "Two-phase commit" architecture

- Transaction history is not materialized and only a relative ordering is assigned between directly related transactions.

- Combines two-phase commit (2PC) and conservative two-phase locking (C2PL) to create a system without a single bottlenecked component where peak transaction throughput scales horizontally with the number of nodes.

- Maximum demonstrated throughput ~1.7M transactions per second.

- Geo-replicated latency <1 second.

Hamilton - OpenCBDC Whitepaper - 2022

Hamilton.Whitepaper-2022-02-02-FINAL2.pdf

My notes

hamilton-cbdc-test-notes1.gdoc

Goals

Researchers have proposed that a CBDC could help address public policy objectives such as ensuring public access to central bank money, fostering payment competitiveness and resilience, supporting financial inclusion, and offering a privacy-preserving digital payment method

Phase 1 goal is to investigate the technical feasibility of a high throughput, low latency, and resilient transaction processor that provides flexibility for a range of eventual CBDC design choices

Summary Outputs

- Hamilton uses UXTO - unspent transaction output model

Like bitcoin, it tracks fractional transactions in the user wallet.

UTXOs are never modified and must be spent in their entirety. Therefore, Alice who wants to use her $20.00 UTXO to send $4.99 to Bob will create a transaction with two outputs: one $4.99 output meant for Bob and one $15.01 change output meant for Alice herself. In contrast to physical banknotes or coins the UTXO values are not restricted to a fixed set of denominations. Note that it is not required to make change in a system that tracks balances since the default is that the remaining balance stays under the same identifier.

i>>> simplified processing but at the cost of tracking account balances which is common in traditional financial systems

- Hamilton, a flexible transaction processor design that supports a range of models for a CBDC and minimizes data storage in the core transaction processor while supporting self-custody or custody provided by intermediaries

i>>> self custody risks to manage

- A transaction format and implementation for a UHS which together support modularity and extensibility

v>>> provides more efficient storage, performance given only validators need transaction data access

- Two architectures to implement Hamilton: the atomizer architecture which provides a globally ordered history of transactions but is limited in throughput, and the 2PC architecture that scales peak throughput almost linearly with resources but does not provide a globally ordered list of transactions.

v>>> some use cases need ordered transactions and some don’t so both consensus models appear valid

- An evaluation of the performance of the two architectures with different types of transaction workloads. Hamilton and the software to evaluate its performance are implemented in OpenCBDC-tx.

v>>> while very limited functionally, the key takeaway was the comparison of ordered commit to 2PC commit in performance

Other blockchain platforms separate validators from ordering, commit as well ( Fabric for one )

Other platforms also leverage hash data sets to reduce storage requirements ( a sample carbon management app for instance )

Other platforms and applications are implementing some version of layer 2 functionality as well

- Security model is standard for wallet DLT solutions

Simple, performs well but has the normal risks associated with managing wallets, network transactions

i>>> The concept of wallet recovery, backup etc was not in scope

Design Concepts

Unspent Funds = amount of funds, encumbrance predicate, serial number

The encumbrance predicate P takes two arguments: a transaction tx (to be formally defined later) seeking to spend this utxo, and a witness wit. The predicate returns true if and only if the witness signifies that this spending transaction should be authorized.

We express this distinction between otherwise identical UTXOs through a globally unique serial number sn, the third component in a utxo.

Systems Operations: Mint, Transfer, Redeem UXTO

Transfer is a redeem from the seller and a mint to the buyer

Hamilton only accepts and executes Mint and Redeem operations authorized by the issuer, i.e., only the issuer can mint and redeem funds. Similarly, Hamilton only accepts and executes Transfer operations where encumbrances of each consumed UTXO are satisfied (e.g., all three operations are covered by digital signature authorization).

Operation set provides authenticity, durability, availability

Transaction Validation Steps

Validation involves checking the following:

- whether the funds exist to be spent;

- whether the spender has provided authorization to spend the funds; and

- does the transaction preserve balance of funds.

Consensus Models

Atomizer Ordered Transaction Design

Figure 8 shows a diagram of the components in the atomizer architecture and the data flow between components.

The order of messages during normal transaction execution are described below:

- User wallet submits a valid transaction to the sentinel for execution by the system.

- Sentinel validates the transaction and responds to the user that the transaction is valid and is now pending execution.

- Sentinel converts the transaction to a compact transaction and forwards it to the shards.

- Shards check the input UHS IDs are unspent and forward the compact transaction to the atomizer. The shards attach their current block height and the list of input indexes the shard is attesting are unspent to the notification.

- Atomizer collects notifications from shards and appends the compact transaction to its current block once a full set of attestations for all transaction input UHS IDs have been received. Once the make block timer has expired, the atomizer seals the current block and broadcasts it to listeners. Shards update their current block height and their set of unspent UHS IDs by deleting UHS IDs spent by transactions in the block and creating newly created UHS IDs. The watchtower updates its cache of UHS IDs to indicate which have been spent and created recently.

- User wallet queries the watchtower to determine whether their transaction has been successfully executed.

- Watchtower responds to the user wallet to confirm the transaction has succeeded.

2 Phase Commit Transaction Design

Figure 9 shows a diagram of the components in the 2PC architecture and the data flow between components. The order of messages during a single transaction’s successful execution are described below:

- User wallet submits a valid transaction to sentinel.

- Sentinel converts the transaction to a compact transaction and forwards it to the coordinator.

- Coordinator splits input and output UHS IDs to be relevant for each shard and issues a prepare with each UHS ID subset.

- Each shard locks the relevant input IDs and reserves output IDs, records data about the transaction locally, and responds to coordinator indicating it was successful.

- Coordinator issues a commit to each shard.

- Each shard finalizes the transaction by atomically deleting the input IDs, creating the output IDs, and updating local transaction state about the status of the transaction. The shard then responds to coordinator to indicate that the commit was successful

- Coordinator issues a discard to each shard informing them that the transaction is now complete and it can forget the relevant transaction state.

- Coordinator responds to sentinel indicating that the transaction was successfully executed.

- Sentinel responds to user wallet, forwarding success response from coordinator.

Escrow Payment Model on Ethereum

Open Source Ethereum Smart Contract that allows 2 transacting parties, a Buyer and Seller, to transact with their choice of Escrow Agent.

How It Works

When Buyer initializes an escrow transaction, his Ether is locked in the smart contract. Once Buyer confirms the Seller’s obligations are fulfilled, he can release funds to Seller. An Escrow Agent, chosen by the Buyer and Seller oversees the transaction. If a dispute occurs, the Escrow Agent can intervene and refund the Buyer, or release funds to the Seller.

Project Hamilton Phase 2 - 2023

Phase 1 of Project Hamilton used a good, creative approach to engineering comparing an ordered set of blocks to simple 2 phase commits for distributed data. There was excellent performance and a ton of good learning delivered. For Phase 2, given most organizations won't run nodes directly, what is the architecture strategy for high acid transaction performance on simulated payments for a CBDC network where CBDC payments integrate to other networks on payments and assets?

Digital Dollar Project - US CBDC testing

Final Report on Digital Dollar Project CBDC white paper - 2023 - Jennifer Lassiter

The Digital Dollar Project's inaugural 2020 white paper urged the United States to accelerate the consideration of a digital dollar through real-world experimentation and proposed a "champion model" of a digital dollar for public consideration. Today we are proud to announce the release of our updated 2023 white paper (https://lnkd.in/gahCjMsp), where we revisit our champion model, provide recommendations to the U.S. government and U.S. private sector and look ahead to the next stage in the evolution of #CBDC development.

Given developments over the past few years, we have an even stronger conviction that the United States has an essential role in setting international standards for digital currencies independent of the decision of whether or not to deploy a U.S. CBDC. The United States must take an active role to ensure that the democratic values of a free society, including financial #privacy and economic #freedom, are enshrined in the future of money.

DDP CBDC Whitepaper 2023

DDP-CBDC-Whitepaper-2.0_2023.pdf link

DDP-CBDC-Whitepaper-2.0_2023.pdf file

Announcement - DTCC Project Lithium looks at CBDC in post-trade settlement

“Project Lithium” prototype will test the ability of U.S. market infrastructure to support a Fed-issued central bank digital currency using a DLT platform

As the U.S. government advances its analysis into the risks and benefits of a Central Bank Digital Currency (CBDC), The Depository Trust & Clearing Corporation (DTCC), the premier post-trade market infrastructure for the global financial services industry, today announced the development of the first prototype to explore how a CBDC might operate in the U.S clearing and settlement infrastructure leveraging distributed ledger technology (DLT). The prototype, known as Project Lithium, will measure the benefits of a CBDC and inform the future design of the firm’s clearing and settlement offerings. It will also explore how a CBDC could enable atomic settlement, a conditional settlement that occurs if delivery and payment are both received at the same time.

demonstrate the direct, bilateral settlement of cash tokens between participants in real-time delivery-versus-payment (DVP) settlement. The pilot will also identify how it can leverage DTCC’s robust clearing and settlement capabilities to fully realize the potential benefits of a CBDC, including:

- Reduced counterparty risk and trapped liquidity

- Increased capital efficiency

- A more efficient, automated workflow

- The guarantee that cash and securities are delivered

- Added transparency to regulators

DDP is facilitating a series of retail and wholesale pilots to evaluate how a central bank-issued currency might work across U.S. financial infrastructure and the American social landscape.

David Treat, Accenture: "The direct exchange of tokenized assets for Central Bank Digital Currency provides a tremendous basis for simplification, efficiency, and a new product and services innovation frontier. We applaud DTCC’s continued leadership and focus.”

With over 45 years of experience, DTCC is the premier post-trade market infrastructure for the global financial services industry. From 21 locations around the world,

In 2021, DTCC’s subsidiaries processed securities transactions valued at nearly U.S. $2.4 quadrillion.

q>>> shouldn't atomic settlement model be defined outside of the payment and asset types? yes

Project Lithium CBDC concepts v1 link

References for Lithium project

Digital Dollar Project

https://digitaldollarproject.org/

CBDC policy maker toolkit

https://www3.weforum.org/docs/WEF_CBDC_Policymaker_Toolkit.pdf

ISSA on Blueprint for CBDC in post-trade settlement

https://finance.yahoo.com/news/clearing-house-cbdc-142923910.html

Compare CBDC Projects

ion

tokenized assets

1 network

Corda DLT

lithium

tokenized assets

2 networks: securities, CBDC

Corda DLT

API P2P

DTM - DTCC Transaction Manager for asset atomic swaps cross network

fnality

tokenized assets

2 networks: securities, multiple stable coins

Corda, Ethereum DLTs

API P2P

DTM - DTCC Transaction Manager for asset atomic swaps cross network

Swift POC

tokenized assets

multiple networks: multiple currencies

multiple DLTs: Quorum, Corda

API Firefly Supernode Gateway Network

Swift Transaction Manager for asset atomic swaps cross network

ISO 20022 paynents messages standard

Business Rules Workflow Engine

Hyperledger Projects focused on CBDC

ebook

Key Concepts

CBDC concepts & models reviewed - 2024

Macroeconomic modeling of CBDC

we review 12 macro-economic papers identifying such effects. We try to match the design assumptions and modelling of these papers with the design announcements of central banks working on CBDC and argue that most of the macro -literature relies on an earlier narrative (unlimited volumes of CBDC, remuneration, etc.) which is inconsistent with most central banks' plans. Moreover, the literature assumes that CBDC would be issued into an otherwise static monetary and financial system (although in reality CBDC is a reaction to ongoing significant changes) and the way it distinguishes CBDC from banknotes is often insufficient.

cbdc-Macroeconomic modelling of CBDC review - 2024.pdf. link

cbdc-Macroeconomic modelling of CBDC review - 2024.pdf. file

A review of the literature reveals

that macroeconomic models of CBDC often start from an early CBDC narrative which is no longer in

line with the one of central banks actually working on CBDC. In particular, the literature often

- (i) does not take into account the nature of central banks’ CBDC issuance plans as a “conservative” reaction to

profound technological and preferential shifts in the use of money as a means of payments, - (ii) does not start from design features communicated by central banks, such as no-remuneration, quantity

limits, access restrictions, and automated sweeping functionality linking CBDC wallets with

commercial bank accounts; - (iii) does not explain well enough the difference between CBDC and

banknotes within their macro-economic models, apart from remuneration (which central banks

actually do not foresee); and - (iv) assume that CBDC will lead to a significant increase in the total

holdings of central bank money in the economy, although (i) and (ii) make this unlikely.

Review of Macroeconomic modeling of CBDC

CBDC in Wholesale Markets - 2022

https://www.linkedin.com/pulse/wholesale-cbdc-considerations-digital-assets-sristhi-assudani/

In fact , central bank money has been available in digital form for wholesale transactions between banks for decades.With innovative technologies like DLT , in terms of wholesale markets, settlement systems for financial transactions could be made more efficient in terms of operational costs and use of collateral and liquidity and more secure by implementing wholesale CBDC

Wholesale CBDC refers to the settlement of interbank transfers and related wholesale transactions in central bank reserves.

Work on wholesale CBDC involves stakeholders that already use digital central bank settlement infrastructure today such as banks, central security depository (CSD) and financial market infrastructures such as central counterparty (CCP) and/or securities settlement systems(SSS).

A potentially unintended consequence is that functions currently being performed by a CCP and SSS are transferred to the DLT platform created . However, the legal considerations thrown up by this arrangement are complex .

Interoperable CBDC systems could help to simplify and enhance the performance and accessibility of cross border and cross currency payments.It can also facilitate increased automation through the use of smart contracts .

In its Annual Economic Report, the Bank for International Settlements announced that it was drawing up a blueprint for a future monetary system grounded in digital representation of CBDCs, noting that such a system could “combine innovation with essential attributes such as safety, stability, accountability, openness, and efficiency”, but also highlighting the structural issues with the current crypto market at present, outlining the inherent risks in its design, suggesting that CBDCs would provide the necessary trust to bring stability.

Bank for International Settlements announced that it was drawing up a blueprint for a future monetary system grounded in digital representation of CBDC

CBDCs can coexist with existing settlement systems and payment mechanisms, and whether private sector providers should be involved in CBDC systems

Wholesale CBDCs are intended for the settlement of interbank transfers and related wholesale transactions, for example to settle payments between financial institutions. They could encompass digital assets or cross-border payments.

CBDC for Security Settlements

Securities are tradable financial assets issued to raise funds from investors.Today, most securities are book entries maintained , at least in part , at a CSD. Some countries have a direct holding system, which means that each beneficial owner has an individual account with the CSD.More common, however, is an indirect holding system, where intermediaries (eg custodians, brokers) hold securities on behalf of their clients with the CSDs.

In the case of securities transactions in most markets, settlement normally occurs two business days after the trade date to allow for a certain number of cash funding and processing steps to occur.

The exchange of cash and securities is normally carried out in a Securities Settlement System (SSS) operated by a Central Securities Depository (CSD) and by corresponding debits and credits of securities throughout the custody chain. Generally, this is done on a Delivery vs Payment (DvP) model. In other words, delivery occurs only if the corresponding payment occurs.

CBDCs could create efficiency for securities settlement transactions but only to the extent that the trading, clearing and settlement legs of the transaction are operated on the same or interoperable digital platforms, such as DLT platforms.

In this use case, using CBDCs for settling the transaction does not materially change the transaction flow for buyer and seller because it relies on intermediation. However, the perceived benefit would be a much shorter settlement cycle which is close to instantaneous – so called atomic settlement.

Benefits vs Costs for faster settlement with DLT and Tokens

Whilst a reduced settlement cycle lowers the exposure to replacement cost risk, market participants may not necessarily favour shorter settlement cycles, as this would potentially require additional liquidity because a market making institution would not have time to source the cash / securities it needs to settle the transaction.

Using tokens and the underlying DLT may offer a number of benefits. It could reduce the complexity in securities settlement by facilitating simpler, more direct holding systems. It can also facilitate increased automation through the use of smart contracts.

Bank Of International Settlements Publishes Future Monetary System - 2022

https://www.bis.org/publ/arpdf/ar2022e3.pdf

Key takeaways

- A burst of creative innovation is under way in money and payments, opening up vistas of a future

digital monetary system that adapts continuously to serve the public interest. - Structural flaws make the crypto universe unsuitable as the basis for a monetary system: it lacks a

stable nominal anchor, while limits to its scalability result in fragmentation. Contrary to the

decentralisation narrative, crypto often relies on unregulated intermediaries that pose financial risks. - A system grounded in central bank money offers a sounder basis for innovation, ensuring that

services are stable and interoperable, domestically and across borders. Such a system can sustain a

virtuous circle of trust and adaptability through network effects. - New capabilities such as programmability, composability and tokenisation are not the preserve of

crypto, but can instead be built on top of central bank digital currencies (CBDCs), fast payment

systems and associated data architectures.

Bank Of International Settlements Publishes A Blueprint For Instant Cross Border Payments Called Nexus article - 2021

Bank Of International Settlements Nexus is a blueprint for instant cross-border payments

Nexus is a model for connecting multiple national payment systems into a cross-border platform that could enable international payments to happen as quickly as sending a text message.

More than 60 countries already have instant (or "fast") payment systems that allow people to send money to each other within seconds. However, sending money abroad is often still slow and expensive. Connecting these national systems internationally, through Nexus, could improve the speed, cost and transparency of cross-border payments.

This summary report addresses the challenges that would need to be overcome and explains how a bridging platform like Nexus could streamline the process of linking national systems. It makes recommendations for countries that are upgrading or rebuilding their payments technology to prepare for cross-border interoperability.

The accompanying technical documents provide much more detail on the functionality required by payments systems operators, their member banks and service providers, along with proposed message flows and specifications for application programming interfaces (API) that will link different platforms.

The BIS Innovation Hub has developed this blueprint through 30 workshops with instant payment system operators, central banks, and large banks who are active in foreign exchange markets and cross-border payments.

We are now testing and improving on this blueprint through an experimental prototype of Nexus that will connect at least three payment systems – currently, those of Singapore, Malaysia and the euro area. This experiment will process simulated payments but will not handle real money or actual payments from real users.

<<Jim - ReFi - effective, future monetary system need redesigned platforms, regulations, economics and governance.

ReFi - ReimagineFinance ( vs DeFi, CeFi )

ReFi was proposed in 2020 to Reimagine Finance ( vs DeFi - decentralize finance ). Reimagine Finance looks at new solutions, roles using new technologies to evolve the existing financial markets, regulations and infrastructures to make them overall more efficient, effective, secure and accessible for a wider audience.

<<Jim - a good global monetary solution isn't the simple DeFi we know now. It comes from ReFi as a team sport

It supports complex landscapes, relations, services, privacy, security, risks, permissions, identities, regulations, standards, compliance, trust engineering, taxation, FX, liquidity, insurance, custody, credit, asset registration, DvP

<<Jim -the FSN - Financial Services Network: Layered, connected, event-driven workflow services with a diverse economic model for DvP, mcbdc

the concept of interoperable service networks is more than just DLT interoperability. Different than the current internet, this is based on ADT - Automated Digital Trust using digital identities, credentials, roles, permissions, trusts and proofs. This platform supports multiple parties, services, solutions and supports EDW - Event Driven Workflows

<<Jim - Hyperledger Public Sector - Future Financial Conversations - FFC

links with EUBOF, RI, Liechtenstein, Swift, David Treat,

A New Era for Money- CBDC - BCG - 2022