m Blockchain Financial Services - DeFi - NFTs

Key Points

- Some interesting blockchain solutions have been listed under Candidate Solutions below

- There are multiple blockchain frameworks and platforms available

- Some target enterprise, permissioned blockchain requirements like Hyperledger

References

| Reference_description_with_linked_URLs______________________________ | Notes_________________________________________________________________ |

|---|---|

| m Blockchain Regulation Trends | |

| DeFi - Tokenized DvP use cases p1 | |

| POS Proof of Stake and Liquidity Pools | |

| m Token Economy Examples: Tokenomics | |

| capital markets, securities management concepts | |

| m Digital Currency and CBDC | |

| Digital Money Concepts | |

open-banking-opportunities-report linkedin | Towards a system that provides incentives for all participants |

| https://hackernoon.com/everything-you-need-to-know-about-smart-contracts-a- beginners-guide-c13cc138378a | Smart Contracts concepts Everything You Need to Know About Smart Contracts: A Beginner’s Guide |

| https://www.eublockchainforum.eu/sites/default/files/reports/report_scalaibility_ 06_03_2019.pdf?width=1024&height=800&iframe=true | EU report on Blockchain interoperability, sustainability |

| Blockchain interoperability concepts and architecture https://www.eublockchainforum.eu/sites/default/files/reports/report_scalaibility_ 06_03_2019.pdf?width=1024&height=800&iframe=true | Thomas Hardjono - MIT Trust Data Science |

https://www.hyperledger.org/wp-content/uploads/2016/10/Leading-the-pack-in- banking-blockchain-survey-2016-ibm-Leading-the-pack-in-blockchain-banking-1.pdf | Blockchain in Banking Study - IBM - 2016 ?? Corda biggest in sector in 2020 |

| Fundamental Analytics on Blockchain data - primarily crypto - ebook | |

| https://www.sec.gov/rules/final/2020/34-90610.pdf | SEC securities trading regulations 2020 |

Insolar enterprise blockchain review | It's a new blockchain that will have production deployments available beginning Q4 2019. |

| https://objectcomputing.com/resources/publications/sett/march-2017-graphene- an-open-source-blockchain | Graphene blockchain introduction - Object Computing |

| https://smartym.pro/blog/what-is-graphene-blockchain-and-why-should-develop -a-graphene-based-project/ | Graphene candidate use cases |

| http://docs.bitshares.org/ | Graphene technical documentation |

| https://objectcomputing.com/services/blockchain-consulting/resources/is- blockchain-right-for-your-business | Blockchain concepts from Object Computing - focuses on EOS - ( a limited version of Ethereum ) >> NOT GOOD ... basic concepts are somewhat generic >> GOOD |

| https://fetch.ai/ | Fetch.AI - open source tokenomics for decentralized agents Fetch.AI is a decentralised digital world in which useful economic activity takes place. This activity is performed by Autonomous Agents. These are digital entities that can transact independently of human intervention and can represent themselves, devices, services or individuals. Agents can work alone or together to construct solutions to today’s complex problems. |

Blockchain solutions and use cases | |

european-financial-stability-and-integration-review-2022_en.pdf site european-financial-stability-and-integration-review-2022_en.pdf file | european-financial-stability-and-integration-review-2022_en.pdf |

https://www.occ.gov/topics/charters-and-licensing/interpretations-and-actions/2020/int1170.pdf https://www.fidelitydigitalassets.com/articles/occ-authorizes-cryptocurrency-custody | OCC Letter on Banks digital asset custody rules |

blockchain-settlement-govt-bonds-france-mvp-1634706515029.pdf | France tries bond settlements on blockchain |

| https://www.mas.gov.sg/news/media-releases/2022/first-industry-pilot-for-digital-asset-and-decentralised-finance-goes-live | JPM - Singapore and Japan swap tokenized bonds directly in POC wo intermediaries demonstrate that cross currency transactions of tokenised assets can be traded, cleared and settled instantaneously among direct participants. This frees up costs involved in executing trades through clearing and settlement intermediaries, and the management of bilateral counterparty trading relationships as required in today’s over-the-counter (OTC) markets. |

| https://www.ledgerinsights.com/dbs-bank-ant-trade-finance-blockchain-trusple/ | DBS Bank Trade Finance solution |

| https://drive.google.com/drive/u/1/folders/1_DT0Gr1aEICAO9qSBqB3W6irmLiqY8sQ | MOBI Finance team - jm9gm jmdmx folder access |

https://developers.facebook.com/videos/2019/mobile-innovation-with-react-native- | Canadian banks unite to offer verified.me a global blockchain identity solution based on Hyperledger Fabric SecureKey built the solution on IBM Blockchain platform |

| https://www.forbes.com/sites/michaeldelcastillo/2019/04/16/blockchain-goes-to-work /#4096e2092a40 | Forbes - 2019 - large blockchain use cases. Over 50% use Fabric |

| https://www.ibm.com/blockchain/solutions/food-trust | IBM Food Trust Network |

Payment Solutions | |

| Financial Inclusion Use Cases article | Financial Inclusion Use Cases article pdf |

| SWIFT payment std: IS20022 for Dummies book pdf | global xml data dictionary with methods ( who is the host ?? ) |

| https://finance.yahoo.com/news/softbank-develop-cross-carrier-blockchain-050039037.html | IBM Cross Border Carrier Payments solution coming |

https://cdn2.hubspot.net/hubfs/4795067/Enterprise/ConsenSys-CBDC-White-Paper_ cbdc-proposal-ConsenSys-CBDC-White-Paper_final_2020-01-20.pdf | Proposal for CBDC from Consensys |

| https://www.ledgerinsights.com/letter-of-credit-blockchain-contour-hsbc-ing/ | Letters of Credit - Thailand - Corda |

payments-fed-reserve-2016-DLT-618dc35e6fdc9c94e627788c433919e713eb.pdf | Federal Reserve on DLT for payments, clearing, settlement |

| CBDC-EU-paper-2019-document.pdf | EU on CBDC - 2019 |

| fed-reserve-boston-2019-blockchain-white-paper.pdf | Federal Reserve on Fedcoin - 2019 |

| https://www.bis.org/cpmi/publ/d157.pdf | DLT in payment, clearing, settlement - bis.org - bank for international settlements |

| Mastercard Launches Asia’s First Crypto-Linked Payment Cards | Mastercard Launches Asia’s First Crypto-Linked Payment Cards ** |

Blockchain as a Service - BAAS | |

| https://www.worldsibu.tech/forma/forma-versus-blockchain-as-a-service/ | Forma - runs on Digital Ocean - cross cloud platform |

DeFi use cases and examples | |

Tokenisation: Propelling innovation at speed defi-Tokenization-moving-DeFi-forward-2021-1639244311874.pdf | Discusses asset tokenization in finance for digital and physical assets |

defi-bri-2021-Digital Asset Revolution- The Rise of DeFi.pdf link defi-bri-2021-Digital Asset Revolution- The Rise of DeFi.pdf file | |

| https://cointelegraph.com/news/defi-transforming-lending-routes-on-the-blockchain | DeFi transforming Lending services w crypto ** |

NFT Development Technology | |

| Created and Tested an NFT | |

| want-to-dabble-with-nfts-heres-beginners-getting-starting-page | |

NFT Solutions | |

https://www.yahoo.com/news/problem-nfts-crypto-expert-responds-104049890.html | |

| The Internet Is Just Investment Banking Now | |

| https://news.yahoo.com/defi-land-debuts-staking-gen-140022989.html | |

| DLT Threats | |

| https://www.business-standard.com/article/technology/ice-phishing-attacks-can-risk-secure-blockchain-and-web3-warns-microsoft-122021700965_1.html | ice phishing - account delegation to bad actor from a phishing email |

Glossary | |

| Reconstitute - redefine / rebuild an index | |

IBOR - Investment Book of Record | simple subset of ABOR |

ABOR - Accounting Book of Record | |

| Events | |

| https://aws.amazon.com/events/fsi-cloud-symposium/ | AWS Financial Services Symposium - NYC annually - 5/25/23 |

Purposeful and profitable: Financial inclusion via open banking around the world Mastercard | |

DeFi Reading List Reference

The definitive DeFi reading list

(with links)

Original Vitalik post on DEX concept (Oct ‘16): https://buff.ly/3mhIed7

Early prediction markets (Augur, Aug ‘17): https://buff.ly/3ZJhTWb

Original Uniswap v1 whitepaper (Nov ‘18): https://buff.ly/3LaKQWK

UNI v3: fee tiers, liquidity ranges (Mar ‘21): https://buff.ly/3L6iRYm

DEX unit economics: https://buff.ly/3mpV4Z3

How “Impermanent Loss” works: https://buff.ly/3L10N1I

Original Tether whitepaper (2014): https://buff.ly/3ZMAtwx

Original Tether purpose/context (Nov ‘14): https://buff.ly/3myF4UB

MakerDAO whitepaper (stables lending, Dec ‘17): https://buff.ly/3L2ITvv

Compound whitepaper (money markets, Feb ‘19): https://buff.ly/3ZIugBM

Aave whitepaper (lending pools, Jan ‘20): https://buff.ly/3ZG6Gpc

Frax whitepaper (algo stablecoin, Jul ‘20): https://buff.ly/3L1UCdK

Curve intro (stables DEX, steeper AMM, June ‘21): https://buff.ly/403ET2r

Folius DeFi ‘Initiation' (Dec ‘20): https://buff.ly/3ZKkrDl

DEX business models & moats: https://buff.ly/3kOdGSm

Governance issues at DEXs (the “Curve Wars”): https://buff.ly/3ZJpuUt

Naval/Dragonfly on the good & bad in DeFi (April ‘21): https://buff.ly/3L372Cj

Balaji on bringing all assets on chain (Nov ‘21): https://buff.ly/3Ylyq1m

Bank for Int’l Settlements anti-DeFi (Dec ‘21): https://buff.ly/3ZJAD7N

Regulatory reading list: https://buff.ly/3mAdHtl

Tracking DEX trader holdings: https://buff.ly/3ZN7w3u

DeFi comps today: https://buff.ly/3ZJAwcn

Uniswap user data: https://buff.ly/3ZKXtfj

DEX LPs as options trading (Mar ‘23): https://buff.ly/3ZKklvt

DEX LPs as options (cont’d): https://buff.ly/3mkVhg7

DeFi project funding environment in ‘22 vs. ‘21: https://buff.ly/3ZJomAu

How Uniswap fees are evolving: https://buff.ly/3L36igG

DEXs taking trading market share: https://buff.ly/3L6gpRF

Outlook for stablecoins: https://buff.ly/3YsikTu

The “Liquid Staking Wars”: https://buff.ly/3YmBUAB

Vitalik on what’s next in DeFi (Dec ‘22): https://buff.ly/3VzsMYL

Tokenizing real world assets primer (Feb ‘23): https://buff.ly/3ZMAn89

It's essential to track the day-to-day data.

But it's equally important to establish a strong foundation in the concepts & development of a sector to understand where it's headed.

That's all for now.

Follow me for similar content, and if you have any thoughts, would love to hear from you in the comments.

Key Groups

Hyperledger Capital Markets SIG

https://wiki.hyperledger.org/display/CMSIG/Capital+Markets+SIG

The Capital Markets Special Interest Group (CMSIG) represents industry professionals working together to study how Hyperledger DLTs interact with Capital Markets use cases. This covers issuance and trading of instruments to continued market-making, management of risk, program-trading, regulations, capital requirements, traceability, post trade settlement, custody including corporate actions and more. This group also explores architecture, identity and performance related considerations specific to Capital Markets and DLTs.

capital market concepts

Capital Markets are a way to connect investors and borrowers for long term provision of capital. A way to invest in enterprises, so that funds from investors are put to productive use. Investors or lenders can be individuals or other entities. Borrowers are companies and governments. Although the term market applies to exchanges and associated infrastructure; financial intermediaries like banks connect the various parties together. Investors are compensated directly by borrowers or are rewarded by appreciation of long-term securities. Capital Markets include the stock market and the bond market dealing with equities, bonds, and credit markets. They can also include derivatives. Securities are a way to tokenise underlying assets and have had a long history.

Capital Markets Taxonomy - 2020

CM SIG projects

https://wiki.hyperledger.org/display/CMSIG/CMSIG-Projects

Trade Finance Securitization

different than current receivables factoring

https://wiki.hyperledger.org/display/CMSIG/Trade+Finance+Securitization

Capital Markets Regulations

https://wiki.hyperledger.org/display/CMSIG/CMSIG-Projects-Regulation

Key Regulation Concepts

m Blockchain Regulation Trends

Key Concepts

IBOR vs ABOR

http://www.opeff.com/IBORvsABOR.html

Investment Book of Records aka IBOR and labeled the traditional approach as Accounting Book of Records or ABOR. These newer systems didn't have the capability to conduct full ledger accounting and also in many cases lacked ability to keep track of historical positions and relied on daily position and cash refreshes from an accounting systems.

OpEff pioneered the first ever web based portfolio accounting system, Perfona, that is a hybrid of ABOR and IBOR and is the first system to give the choice to the manager to determine what model to implement.

How blockchain can impact Financial Services

"Any financial operation that has low transparency and limited traceability is vulnerable to disruption by blockchain applications.” –Bruce Weber and Andrew Novocin

https://knowledge.wharton.upenn.edu/article/blockchain-will-impact-financial-sector/

Centralized solutions may migrate to decentralized given trust, compliance

Hosanagar expects the first wave of applications to be rolled out in “private” blockchains where a central authority such as a financial institution and its partners are the only ones with the permission to participate (as opposed to public, permissionless blockchains where participants are anonymous and there is no central authority). Applications in the private blockchains, he said, will be more secure and will offer some of the benefits of decentralized ledgers but will not be radically different from the way things work at present. However, over time, he expects smart contracts (self-executing contracts when requirements are met) to be offered on public blockchain networks like Ethereum. “When securities are traded, intermediaries provide trust, and they charge commissions. Blockchains can help provide such trust in a low-cost manner. But trade of securities is governed by securities laws. Smart contracts offer a way to ensure compliance with the laws. They have great potential because of their ability to reduce costs while being compliant,” says Hosanagar.

Werbach - Important technologies, he said, are far more likely to be integrated into the system than replace it. According to Werbach, while some firms will fail to make the transition and some new ones will take hold, “over the long-run, virtually every historic innovation that eliminated some forms of intermediation also created new forms.

Reduces friction and improves efficiency in financial systems

when a syndicate of lenders participates in a loan, having one shared ledger means they don’t all need to keep track of it independently. International payments and corporate stock records are other examples where there are huge inefficiencies due to duplicate record-keeping and intermediaries. “End users won’t see the changes in the deep plumbing of financial services, but it will allow new service providers to emerge and new products to be offered,” said Werbach.

Sharing governance strategies in new ecosystems first

“Distributed organizations serving an open community need to take care to design their governance systems, incentive structures and decision-making processes to create consensus without unduly slowing down the decision-making,” said Weber and Novocin. “Scenario planning or war gaming are worth exploring at the beginning of blockchain projects. Forward planning enables organizations to swiftly respond in a predictable way that is supportive of stakeholders. Publicizing these plans in advance can also build trust and user confidence.”

Cryptocurrency Risks to date exist

Bitcoin has shown that the fundamental security of its proof-of-work system is sound, but it has major limitations such as limited scalability, massive energy usage and concentration of mining pools. There has been massive theft of cryptocurrencies from the centralized intermediaries that most people use to hold it, and massive fraud by promoters of initial coin offerings and other schemes. Manipulation is widespread on lightly-regulated cryptocurrency exchanges.

Currency regulation and governance

There must be recognition among cryptocurrency proponents that maturation of the industry will require cooperation in many cases with incumbents and regulators,” added Werbach.

It's clear, cryptocurrencies ( where they are legal ) need to comply with KYC, AML and other financial regulations. Blockchain should make that governance simpler and lower cost.

Blockchain continues to evolve

Weber and Novocin expect that in the next few years, many more businesses will implement private blockchains to improve the transparency and traceability of their financial operations, supply chains, inventory management systems and other internal business systems. Clearer standards will be adopted and a few high-profile projects will emerge. Meanwhile, they said, R&D will continue among the many decentralized blockchain projects to invent more scalable public ledgers

Blockchain use case examples in Banking

identity support - KYC, fraud prevention - Indy, Aries

payment processing - AML, SARS

peer to peer payments

improve reconciliations

faster settlements between banks

syndicated lending

letters of credit

digital accounting ledgers replace paper

automate compliance

IBM we.trade for trade finance

non-traditional banking solutions

ICOs

CBDC support

crypto deposits

https://www.omfif.org/wp-content/uploads/2020/05/The-role-of-blockchain-in-banking.pdf

https://www.fintechnews.org/10-use-cases-of-blockchain-technology-in-banking-2020/

https://www.cbinsights.com/research/blockchain-disrupting-banking/

https://customerthink.com/top-5-thought-provoking-use-cases-of-blockchain-in-banking-finance-sector/

https://consensys.net/solutions/payments-and-money/

https://www.ibm.com/blockchain/industries/financial-services

https://www.ibm.com/blockchain/solutions/trade-finance

DTCC for securities settlements

https://www.dtcc.com/news/2020/may/18/dtcc-unveils-proposals-to-explore-further-digitalization

DeFi-Introduction to Decentralized Finance.pdf link

DeFi vs CeFi

DeFi - all apps rely on blockchain for security and integrity

No Intermediaries

– Parties interact directly with smart contracts

<< except parties interact through an app that interacts through an api to access a blockchain and smart contract 99% of the time

Permissionless

– Use of financial application and products

– Creation of financial products

<< except it's not permissionless and it requires privacy according to laws ( see wallets, access, GDPR etc )

Code is the law

– Smart/financial contract is immutable

– Smart contract decides on state changes

<< contract is an instance of a contract type and represents the obligations of the parties usually and MAY reflect the law

Accessibility

– Democratization of financial services

<< except that you are dependent on a different set of exchanges to access and trade in a market in most cases similar to CeFi

Efficiency

– Immediate settlement (few seconds)

– Open 24/7

– Borderless

– Low cost and scalability (L2s)

<< except that trades are subject to the legal jurisdictions they occur ( not borderless ), limited scalability compared to CeFi and not low cost if you look at conversion costs in and out of crypto

Transparency

<< except visibility to the operations of the DEX you trade in has similar viisbility to CeFi, the security of your transactions in wallets, key management etc

Composability

<< composability for the developer not the user of DeFi apps. Users CAN choose a crypto, a wallet, an exchange etc

DEXes

Automated Market Maker Algorithms - AMM

AMM Example on Crypto Buy - you pay over 2% fee for a trade - insane

Yield Farming

Providing tokens to DeFi protocols to participate in fees earned by these protocols

Yield Farming is a process of providing liquidity to DeFi

protocols, similar to liquidity provision of market makers in

TradFi, in exchange for participation in transaction fees

Liquidity Providers (LPs) are referred to as Yield Farmers. Any

blockchain user can become a yield farmer (permissionless).

Technically, yield farming protocols are aggregators that deploy

liquidity to DeFi protocols

Liquid Staking

Liquid Staking is a token, which value tracks staked tokens

Consensus mechanisms – ensures that all nodes in

the blockchain network has the same copy of ledger ( related to blockchain transaction validity - NOT staking )

Proof-of-work (PoW) vs Proof-of-stake (PoS)

❑ PoW uses energy to solve the cryptographic puzzle

❑ PoS puts tokens “at stake” to assure BC correctness

❑ Staking - locking tokens in exchange for staking rewards

❑ Staking rewards come from transaction fees and inflation

Liquid Staking is a token, which value tracks staked

tokens

Synthetic tokens and their target values

❑ Wrapped Tokens -> tokens from other BC

❑ Stablecoins -> fiat currency

❑ Liquid Staking -> staked tokens + staking rewards

Issues

Issues - MEV Opportunities - Flash Loans

Flash loan – un-collateralized loan that must be returned within the same block of transaction, otherwise the flash loan transaction is reverted – used in trading strategies and attacks in DeFi (decentralized finance)

DeFi references

CoinGecko, “How to DeFi, Beginner, Advanced”, 2020 ❑ S. M. Werner, D. Perez, L. Gudgeon, A. Klages-Mundt, D. Harz, and W. J. Knottenbelt, “SoK: Decentralized Finance (DeFi),”, 2020 ❑ J. Xu, K. Paruch, S. Cousaert, and Y. Feng, “SoK: Decentralized Exchanges (DEX) with Automated Market Maker (AMM) Protocols,” 2021 ❑ L. Gudgeon, S. Werner, D. Perez, and W. J. Knottenbelt, “DeFi Protocols for Loanable Funds: Interest Rates, Liquidity and Market Efficiency”, 2020, ❑ S. Cousaert, J. Xu, and T. Matsui, “SoK: Yield Aggregators in DeFi”, 2022 ❑ S. Scharnowski and H. Jahanshahloo, “Liquid Staking: Basis Determinants and Price Discovery,” 2022

FinTech Trends 2024

https://workweek.com/dm/fintech-takes-newsletter/

- Artificial Intelligence (AI) and Machine Learning (ML): Increasing automation and personalization in financial services, including customer interactions and predictive analytics.

- Decentralized Finance (DeFi): Growth of platforms that allow financial activities without traditional intermediaries, potentially mainstreaming in the near future.

- Open Banking: Expansion of ecosystems where banks and fintech companies share data securely, enhancing customer service and product offerings.

- Digital Banks and Neobanks: Continued rise and adoption, offering lower service charges and customer-centric services.

- Cybersecurity Enhancements: Implementing stronger measures like biometrics to secure online transactions and protect user data.

- Customer Engagement Technologies: Utilizing Al, IoT, and other technologies to improve customer service and engagement.

- Sustainable Finance and ESG Compliance: Focusing on environmentally friendly fintech solutions and investments.

- Quantum Computing: Its application in financial modeling and risk management could revolutionize data analysis and forecasting.

- WealthTech: Innovations in wealth management and investment technologies gaining traction.

- Digital Identity and Authentication: Integration of digital wallets to facilitate user identification and streamline financial transactions.

Fidelity Investments

Jason Ward VP

Bhaskar Balan Head Asset Management Technologies

State Street Bank

news.191204 - State Street cuts Fabric investment

was working on Fab coin on Fabric project.

Previously, a large DLT team at State Street had been working with the Hyperledger Fabric open-source permissioned blockchain software.

The aim was to create a single book of record, which could run State Street’s investment book at the front end, an accounting book of record for the middleware and a custody book of record on the back end. This new DLT system would remove the need to reconcile between hundreds of databases, involving hundreds of man-hours each day.

Now, however, the bank is now describing its approach as “ledger-agnostic,” and relying more on outside providers.

“If something is Fabric-related we still have some Fabric engineers on board,” said Achkar, who runs a digital asset product development and innovation team in London, complemented by similar teams in the U.S. and Singapore. But his objective is to identify the best business cases, rather than the best protocol, he said.

“I think the choice in approaching that space was, do we need to have all of these resources internally, or can we actually build partnerships and work with other providers in the market?” he said.

Citizens Bank

FIS Global

Fiserv

AMEX

Amica

Traditional Bank Services Evolve

Key Questions to answer

- Who are our key customer segments?

- What is our solution strategy to service those segments? how well is it working?

- How do they see our brand vs others?

- How do they value us compared to our competitors?

- What's the SWOT for each segment given the competition?

- Where are our services cost-competitive, cost-prohibitive?

- What are the key service metrics our customers expect, value?

- What are our best products for customers? most profitable? high growth?

- Are our products and services competitive with our customer's expectations?

- Who can we partner with to offer full range of products and services to our key segments?

- What associations can help deliver value to our customers now?

- What service providers can provide higher value, quality services to our key segments?

- Do our service providers create gaps in delivery on ease of use, value, cost, operational risks?

- Which services and activities are higher value touch points for people vs online systems?

- Are out chatbots lowering customer satisfaction?

- What automated B2B services do we offer now effectively? where are the gaps?

- How do we lower fixed costs to be more reactive to market demand changes?

- What key technologies do our customers use ( business, consumer ) now? where are they headed ( trends )?

- Have we measured security and trust vs competition? How do customers see us?

- What is our track record on customer-driven innovation that we can point to now?

Focus areas:

- decide what the bank's role should be within their customer segment's future

- customer focus means feedback, data-driven decisions and future service models, products and market messaging

- smart investments in technology and innovation - test external services, solutions, get feedback from pilots, evolve vs re-invent

- build smart governance that is pro-active vs reactive to risks, customer needs

- reset corporate values, mission, culture where needed based on customer needs, opportunities

- avoid NIH syndrome, look at smart partnerships

Securities Trading Process - Simplified Overview

https://www.investopedia.com/terms/d/dtcc.asp

For example, when an investor places an order through their broker—and the trade is made between that broker and another broker or similar financial professional—information about that trade is sent to the NSCC (or an equivalent clearinghouse) for clearinghouse services.

After the NSCC has processed and recorded the trade, they provide a report to the brokers and financial professionals involved. This report includes their net securities positions after the trade and the money that is due to be settled between the two parties.

At this point, the NSCC provides settlement instructions to the DTCC; the DTCC transfers the ownership of the securities from the selling broker's account to the account of the broker who made the purchase. The DTCC is also in charge of transferring funds from the buying broker's account to the account of the broker who made the sale. The broker is then responsible for making the appropriate adjustments to their client's account. This entire process typically happens the same day the transaction occurs. The process for institutional investors is similar to the process for retail investors.

- seller makes offer in Broker A

- buyer accepts offer in Broker B

- trade matched on exchange

- trade sent to clearing

- clearing records trade and notify brokers of net positions and money to settle

- clearing notifies DTCC of settlement requirements

- DTCC transfers security ownership from seller to buyer

- DTCC transfers funds from buyer broker B to seller broker A

- both brokers update buyer and seller account funds

DTCC -

- The Depository Trust and Clearing Corporation (DTCC) is an American financial services company that provides clearing and settlement services for the financial markets.

- The Depository Trust and Clearing Corporation settles the vast majority of securities transactions in the U.S.

- Settlement is an important step in the completion of securities transactions; by ensuring that trades are executed properly and on time, the settlement process contributes to investor confidence and reduces market risk.

DTCC - post trade settlement uses Blockchain

Current Post Trade Process

DTC Project ION -

DTCC’s DLT Based settlement Platform in Parallel Production - Kamlesh Nagware

DTCCs DLT Based settlement Platform in Parallel Production - more to follow.pdf link

DTCCs DLT Based settlement Platform in Parallel Production more to follow.pdf file

The Project Ion platform is now parallel processing an average of over 100,000 bilateral equity transactions per day, and almost 160,000 transactions on peak days, with the DTCC subsidiary.

Project Ion is being designed to adhere to rigorous regulatory standards and deliver the resiliency, volume capacity, security, scalability and risk control that DTCC is known for. Project Ion is also being built to support a netted T+0 settlement cycle, as well as T+2, T+1, and extended settlement cycles. Settling stock trades in the U.S. currently takes two days. The U.S. Securities and Exchange Commission (SEC) has proposed speeding up stock settlement times to something called T+0 – jargon for processing trades the same day they're executed.

Blockchain Network Model for Sharing Data

MIT - Blockchain and Money Course - Fall 2018

DirectBooks - underwriting platform for securities

DirectBooks creates a singular distribution point to manage communications across constituents

owned by Axion

shows how traditional financial institutions that many believed could be threatened by technology popularized by bitcoin, which moves value with less dependence on slow intermediaries, have come up with centralized solutions to accomplish some of the same tasks. “Across the banks, the potential reduction in operational risk is certainly in the hundreds of millions, if not in billions,” of dollars says Johnsson.

Current bond issuance process for underwriting

Currently, when a company like AT&T wants to raise capital, it first posts the amount the company wants to raise and the interest rate it’s offering on a newswire like Bloomberg. A team of salespeople at Deutsche Bank, JPMorgan or any number of other banks then spend the next three hours or so manually calling asset managers at Blackrock, Wellington and others to see if they’re interested.

what Axoni built was a back-office process for the vast array of counterparties to nearly instantly communicate, while the bonds themselves still settle the normal way through the Depository Trust Company in the U.S. and Euroclear in Europe, for example.

DTCC buys Securrency

Jim>>

Securrency acquisition aligns well with the work DTCC has already done planning Digital Asset capabilities for settlement solutions and should produce faster delivery of Digital Asset capabilities in DTCC solutions for clients.

October 19, 2023 ‒ DTCC, the premier market infrastructure for the global financial services industry, today announced it has signed a definitive agreement to acquire Securrency Inc. (“Securrency”), a leading developer of institutional-grade, digital asset infrastructure. The acquisition, which is expected to close within the next several weeks, will position DTCC to provide global leadership in bridging best-in-class industry practices with advanced digital technology to encourage acceptance and adoption of digital assets.

DTCC on Digital Asset Network Interoperability

digital currencies depends on interoperability

dtcc-digital currencies depends on interoperability-atlanticcouncil.org-How can it be achieved.pdf. link

dtcc-digital currencies depends on interoperability-atlanticcouncil.org-How can it be achieved.pdf. file

- We have to remember that DLT was created as the antithesis of regulated financial services and not in order to augment it,” said McLaughlin. “The first thing that you have to do if you want to apply DLT to the regulated spaces,” he said, is “to put a number of fundamental blockchain constructs into the garbage.”

Where there are regulatory gaps or new standards that have to be developed,” said Bleicher, “we have existing institutions that we can leverage to make progress,” including the Group of Seven (G7), the Group of Twenty (G20), and the Financial Stability Board. “There’s much that needs to be done,” he said, “but we do have venues in place that we can use to advance some of this work.”

Where there are regulatory gaps or new standards that have to be developed,” said Bleicher, “we have existing institutions that we can leverage to make progress,” including the Group of Seven (G7), the Group of Twenty (G20), and the Financial Stability Board. “There’s much that needs to be done,” he said, “but we do have venues in place that we can use to advance some of this work.”

Securrency

https://securrency.com/about-us/

Digital Asset Custody Solutions

US Treasury Report on Digital Asset Custody 2022

US Treasury Report on Digital Asset Custody 2022 link

US Treasury Report on Digital Asset Custody 2022.pdf file

NASDAQ Digital Asset Custody Solutions 2022

Nasdaq is taking its first steps into crypto services with an emphasis on security, entering the business with a custody product for bitcoin and ether aimed at institutional investors.

“We feel that custody is foundational to any other service that we build,” says Ira Auerbach, the newly named head of Nasdaq Digital Assets. “The ability to hold on to our customers' funds in a safe, secure, scalable and accessible manner is a key launch point for anything else we do in the future,” added the former head of the Gemini exchange’s crypto prime brokerage.

Clients are required to place enormous trust in their custodians, a confidence that individual investors are skeptical of handing over. This wariness has given rise to the phrase “not your keys, not your crypto,” meaning that private keys – analogous to passwords for the accounts holding crypto funds – do not belong in the hands of intermediaries. Since institutions are unlikely to build out their own infrastructure to custody assets, they need to choose a partner prepared to take custody of institutional-sized cryptocurrency accounts.

When asked why clients would choose a traditional financial player instead of a crypto-native firm to take custody of their digital assets, Auerbach responds that Nasdaq is uniquely positioned because of its knowledge of what institutional clients need in order to use a financial product.

“We have a long history of working with these institutions, we know their pain points, we have products built internally to address these pain points,” Auerbach said. “We think we can make institutions much more comfortable and usher in a larger adoption of the ecosystem.”

In parallel with the custody service, Nasdaq is expanding its anti-financial crime technology to weed out money laundering, fraud and market abuse in digital assets. The advantage Nasdaq has is that the company has the capabilities to analyze potentially fraudulent behavior in both traditional markets and digital assets as well, says Valarie Bannert-Thurner, senior vice president of anti-financial crime technology at Nasdaq.

https://www.investopedia.com/nasdaq-starts-crypto-services-6740707

- Nasdaq competes with established crypto players such as Coinbase to attract institutional investors.

- The stock market operator offers crypto custody as well as expands its services.

- It has hired Gemini alum, Ira Auerbach, to run its digital division.

Institutional investors will be offered custody services for Bitcoin and Ether through this new initiative. With this move, Nasdaq, the second-largest U.S. stock market operator, will offer institutional clients in the U.S. the same services that crypto firms such as Coinbase, Anchorage Digital, and BitGo provide to small financial firms

- Underpins Nasdaq’s Focus on Advancing the Transformation of Markets and Driving Broader Institutional Adoption of Digital Assets

- Subject to Regulatory Approval, Nasdaq Digital Assets Will Provide a Proprietary Custody Solution with Liquidity and Execution Services for Financial Institutions

- Appoints Ira Auerbach, Former Global Head of Gemini Prime, to Lead New Business

- Expands Anti-Financial Crime Technology Capabilities for Digital Assets

Nasdaq Digital Assets will be led by Ira Auerbach, Senior Vice President, Head of Digital Assets, who will oversee the team’s strategic roadmap, growth targets, and product development. Auerbach brings over a decade of leadership experience in building institutional-grade solutions and innovative services across digital assets and traditional finance. Auerbach joined Nasdaq from Gemini, where he held several executive positions across product, business development, and trading. Most recently he was the Global Head of Gemini Prime, the crypto platform’s prime brokerage services.

“Demand among institutional investors for engaging in digital assets has increased in recent years, and Nasdaq is well-positioned to accelerate broader adoption and drive sustainable growth,” said Tal Cohen, Executive Vice President and Head of North American Markets, Nasdaq. “With our trusted brand and strong track record as a technology provider for the global capital markets, Nasdaq is uniquely placed to address industry pain points by improving liquidity, scalability, and resiliency, with the goal to engender greater trust and confidence in the digital assets ecosystem.”

Adena Friedman, President and Chief Executive Officer, Nasdaq. “The technology that underpins the digital asset ecosystem has the potential to transform markets over the long-term. To deliver on that opportunity, our focus will be to provide institutional-grade solutions that bring greater liquidity, integrity, and transparency to support the evolution.”

Anti-crime focus for digital assets

The integrity of the digital landscape is key to realizing the full potential of digital assets. Yet, cryptocurrency-based money laundering activity reached $8.6 billion in 2021, a 30% increase from 2020.1

To play a central role in combatting the rising threat of financial crime across the digital assets financial landscape, Nasdaq has expanded its anti-financial crime technology with new capabilities and coverage for the cryptocurrency ecosystem. Through its Verafin and Surveillance product offerings, Nasdaq has launched a comprehensive suite of crypto-specific detection capabilities to effectively mitigate risks and provide continuous monitoring of anti-money laundering, fraud detection, and market abuse across traditional and digital assets, fiat and crypto, and on- and off-chain activities.

“Our expanded suite of anti-financial crime solutions reinforces our commitment to protecting the integrity of the financial system,” said Jamie King, Executive Vice President, Head of Anti-Financial Crime, Nasdaq. “As the world of digital assets evolves and converges with traditional finance, it is crucial to provide the necessary portfolio of technology solutions designed to safeguard participants across the financial ecosystem.”

ESMA ( EU’s securities markets regulator ) DLT Pilot Program for securities RTS

https://www.esma.europa.eu/press-news/esma-news/esma-publishes-report-dlt-pilot-regime

European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has today published its Report on the distributed ledger technology pilot regime (DLT Pilot). In the report, ESMA provides guidance on certain technical elements and makes recommendations on compensatory measures on supervisory data to ensure a consistent application by DLT market infrastructures from the start of the regime.

The DLT Pilot Regime is part of the Digital Finance Package introduced by the European Commission in 2020 to further enable and support the potential of digital finance while mitigating associated potential risks. The Regulation on a pilot regime for market infrastructures based on the DLT Pilot aims at developing the trading and settlement for DLT financial instruments. The DLT Pilot requires ESMA to assess whether the RTS developed under MiFIR relative to certain pre- and post-trade transparency and data reporting requirements need to be amended to be effectively applied also to securities issued, traded, and recorded on DLT.

The ESMA DLT report - 2022

esma70-securities-market-regulator-2022-460-111_report_on_the_dlt_pilot_regime.pdf link

esma70-securities-market-regulator-2022-460-111_report_on_the_dlt_pilot_regime.pdf file

DeFi Concepts

Web 3 technologies help drive DeFi solutions

DeFi, in a nutshell, is an alternative financial infrastructure that is decentralized (i.e., intermediaries do not need to exist between parties to a financial transaction) and built on smart contracts

Tokenization of assets supports DeFi

Tokenisation: Propelling innovation at speed

defi-Tokenization-moving-DeFi-forward-2021-1639244311874.pdf

potential to cause disintermediation to financial institutions through the use of smart contracts, creating programmable assets

peer-to-peer market where financial services can be delivered in an automatic, trustless manner. DeFi has given rise to a wide range of new investment opportunities. In this ecosystem, lending, synthetic assets, insurance and automatic token exchanges can happen directly between parties who use the same blockchain via dapps. DeFi Lending protocols have emerged which allow users to borrow and lend digital assets directly to other users, with interest rates fluctuating in real time based on supply and demand. This removes the need to pay fees to a central third party and creates greater flexibility – there are no pre-defined loan durations and users are free to withdraw or repay at any time.

<<<

- costs to move in and out of tokens to fiat is very high now - will come down to reasonable levels at some point

- most exchanges charge high trading fees with little guarantees compared to conventional financial systems

- tier 1 financial systems are more secure today

- blockchain networks have limited interoperability today compared to traditional financial systems

>>>

Asset Tokenization Use Cases - Fungible and Non-Fungible

Advantages of Digitized Assets and EU Digital Product Passport

EU Digital Product Passport Review - 231112

EU Digital Product Passport tokenization-2023.pdf link

EU Digital Product Passport tokenization-2023.pdf file

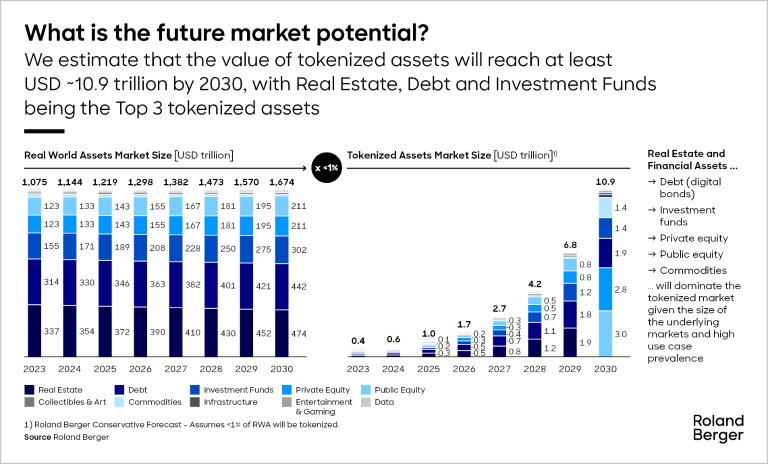

In this Report , https://lnkd.in/desvDEVP. @rolandberger lay out the basics of tokenization, the main use cases

Staking ( like CDs ) provides yield and POS to participate in governance decisions

Yield farming, lending and staking of cryptoassets to generate returns are additional investment opportunities. Staking involves locking up cryptoassets and agreeing not to withdraw them for a period of time as a way of contributing to a blockchain network. In return, stakers can earn additional coins or tokens. Staking also allows investors to participate in the governance of the blockchain protocol. For example, on a ‘proof of stake’ blockchain

DAO

Decentralized Autonomous Organisations (DAO) are member owned communities without a typical centralized leadership and management structure

<<< practically there will be contracted teams to administer these networks

can existing financial services providers provide efficient, trusted DeFi services better than new operators using similar technologies??

>>>

NFTs provide unique opportunities to create value from any type of asset

NFTs have opened up unprecedented opportunities for investors to purchase assets directly from the creators, without the need for a centralized party.

NFTs are digital assets that represent unique tangible and intangible assets – which can range from digital art, videos, sneakers5 , sports cards and even a tweet . As its name suggests, these tokens are nonfungible, meaning they cannot be exchanged for one another, and each NFT is unique

NFTs can be programmed with specific parameters. For example, conditions can be specified such that whenever the NFT is resold, the original creator can receive a percentage of income from the resale of their artwork. With such innovative characteristics, it’s enormously appealing for both creators and investors to jump into this digital ecosystem.

Carbon offsets market growing

In September 2021, MOSS, the largest environmental platform globally to tokenize carbon credits, listed their MCO2 token on Gemini, a major digital assets exchange, enabling accessibility to a wider investor base and sending US$10 million in 8 months to Amazon forest conservation projects

Net zero sustainable product models

net-zero tokenized gold products – structured such that for each ounce of gold purchased, sufficient carbon credit tokens will be bought to offset the carbon footprint of the gold. This provides investors with a sustainable way to invest in commodities and facilitates the transition to a net-zero economy.

a>>> doc the p2p trading app

a>>> doc the carbon offsets market app

Asset transformations > physical assets > digital assets > tokenized assets

Asset branding concepts

combinations of origination, authentication, historical significance, original designs, humor, integrity, kindness, sustainability support, fairness, and stories, series of related works as limited editions, the story is the biggest part of the value journey

see the best serialization asset creators in the past for branding

SPAC ownership of NFTs as an option

Can Tokenization can enable existing assets to be customized at a granular level at a lower cost. ?

If the end to end solution can be delivered at lower risk, cost through automation, execution of asset management using digital identity

Automation of bond coupon payments impacts lowers cost, improves investor flexibility

a tokenized bond, smart contracts can automatically compute and execute coupon payments, significantly lowering the cost involved. Coupons could easily be paid weekly or even daily. Issuers would have much greater flexibility to tailor and customize bond terms to meet investor preferences

Need for trusted, open digital asset exchanges connecting asset networks with buyers, sellers, traders

licensed digital asset exchanges in jurisdictions such as Singapore, Hong Kong10 and Switzerland, to NFT marketplaces like Nifty Gateway and OpenSea. These infrastructures are vital in driving demand and accelerating innovation in this space. However, most still exist as disparate ecosystems, and there is a need for DLT bridges to enhance interoperability among various networks.

a>>> compare existing digital asset markets on costs, stability, risks, asset types, capacity, ease of use, security

DeFi Challenges

digital asset markets on costs, stability, risks, asset types, capacity, ease of use, security, fees, conversion costs, IAM, provenance, settlements, interoperability

these initiatives usually exist in their disparate blockchains, operating in silos, resulting in unrealized benefits of a cumulative network effect.

Interoperability solution directions

There are numerous way of integrating blockchains either through APIs or network of networks effect. For the former, APIs can help integrate two separate blockchains on an individualized basis. However, the lack of a defined governance can make integrations between multiple blockchains onerous. For the latter, relying on multiple network connections across blockchains and establishing industry token standards can scale and create a congruous environment for cross-blockchain applications. Well-known token standards such as the ERC-20, an interface for fungible tokens, are increasingly used to support compatibility with the Ethereum network. Furthermore, smart contract languages such as Digital Assets Modeling Language (DAML) can make future integrations possible through enabling interoperability across enterprise blockchains. Various other initiatives include companies such as Consensys11, who has developed a universal token that can support all asset types across both centralized and decentralized use cases on the Ethereum blockchain. In realizing a multi-chain future, blockchain bridges (e.g., Polkadot) can be used to connect different chains that have distinct governance and rules, relaying external data and tokens.

Standards on asset protocols, accounts, custody key to integrate existing, new financial services

With the growth of DeFi protocols, there is a role that traditional financial institutions can play to serve as a conduit between traditional finance and DeFi.

How are DeFi business design assumptions defined and validated?

new definitions of M1 to M4

asset registrations

account registrations

account agents

asset exchanges

- clear and settle trades within an exchange

- net or direct asset transfers across exchanges

asset brokers / dealers ( like real estate )

- clear and settle trades within an broker

- net or direct asset transfers across brokers

decentralization methods to deliver value

risk assessments, underwriting, insurance

security

regulation management and enforcement

- regulatory uncertainty as a key challenge. Several jurisdictions, including Singapore, Hong Kong and the United Kingdom have since made progress in this area and have released guidance specifying that tokenized forms of traditional securities remain subject to existing regulatory regimes governing traditional financial securities. Moreover, some regulators have introduced a fresh set of legislation to modulate the issuance of asset tokens. While this is a good start, greater clarity, communication and consistency from regulatory bodies around the world is essential to spur innovation and growth in this space

- see Liechtenstein, Estonia, Wyoming, Rhode Island, EUBOF on regulation concepts

- SEC, FDIC, OCC, Fed, Fincen

- States: RI, Wyoming

- EU - EUBOF, EC regs

- uniformlaws.org link

- EU legal content

- legiscan for US laws

asset trade management - types, authorizations, consents, notarizations, escrow, reserves, margin, clearance, settlement

custody management - vaults, access

- As decentralized exchanges are non-custodial, a credible third party like a custodian can be involved to provide protection of private keys and ensure a safe transfer of assets from off-chain to on-chain

- A potential role for banks to consider would be to serve as a universal adaptor to various DeFi networks. This would help to bridge the gap between the traditional fiat economy and the decentralized economy.

identity and access management

privacy controls

consent management

proof of governance

The DeFi roadmap forward

what are the success keys for the market? for the parties, roles?

when will the DeFi network effect reach a turning point?

how does investment finance and trade finance overlap in DeFi?

what are the threats? who are the attackers?

DEFI Mind map

https://www.linkedin.com/posts/rohasnagpal_defi-crypto-blockchain-activity-6855782716995076096-pmu6

DEFI Opinions

Anthony Day, IBM

This chart shows a good overview across stablecoins, custodians, KYC and the protocols / dApps offering financial products.

As I was discussing with David Palmer in yesterday’s comments, we’re already seeing established banks (CeFi / TradFi) making DeFi, Crypto and Digital Assets available to their customers as alternative products, but it’s not necessary for banks to be the ‘front end’.

Do you see banks as a major player in the growth of DeFi, or do you believe the Web3 revolution will be led by individuals themselves?

<< "I expect the innovators will evolve Financial Services DeFi capabilities faster and the existing players will adapt and productionize those well also" Jim Mason

verified.me SecureKey design

Design overview for Fabric with proposed enhancements for DID, Indy support

https://docs.google.com/document/d/1ENMO-S7i0ef09IRx5teE-eJbRMFsaKSXEdatcufvjPM/edit

SecureKey Technologies is launching an interoperability initiative aimed at establishing common standards and development frameworks for next generation digital identity networks.

Contributions

We will support the efforts within the Hyperledger and Decentralized Identity Foundation (DIF) communities to help create innovative distributed ledger technologies and digital identity networks. We believe that creating cross-project and cross-network standardization and interop along with common development frameworks represents the next step in transforming the digital identity space. In particular we support, and look forward to contributing to, the efforts of Hyperledger Fabric, Indy and the newly proposed Aries project along with DIF’s Identity Hub efforts.

Contributions will be directed towards the community projects above as well as open project extensions within the TrustBloc initiative.

In particular, we will contribute:

- Hyperledger Fabric performance and customization improvements. We are excited to contribute improvements we learned while building and taking our network operational.

- Enable DIDs to be managed and exposed from Fabric, and more generically enabling document provenance.

- A model for digital identity exchange based on DIDs, Verifiable Credentials, and Hubs.

- Efforts towards interoperability with the newly proposed Hyperledger Aries project, in order to use a Fabric-based ledger and our digital identity model. We think it’s critical to allow variation on top of a common base.

- Tooling and demos to enhance developer experiences building digital identity networks.

About SecureKey

SecureKey builds identity networks like Verified.Me, the Canadian identity sharing Network supported by seven major banks, mobile operators, a major credit agency, and other providers in Canada. Verified.Me provides a user centric, privacy protecting identity platform for services that trust the individual’s identity established at their financial institution and other connected organizations. Users can link in account information across services for a convenient but highly reliable digital identity where information is delivered in real time.

Technical Brief

In the following diagram, we provide an overview of the components related to the TrustBloc initiative. We will follow-up with additional details and data exchange flows.

IBM Cross Border Carrier Payments solution coming

https://finance.yahoo.com/news/softbank-develop-cross-carrier-blockchain-050039037.html

SoftBank is teaming up with IBM to develop cross-carrier blockchain solutions, with the focus on technologies that will allow smartphone users to make local payments when traveling overseas and roaming.

first project being undertaken by the CBSG is the Cross-Carrier Payment System (CCPS), which is aimed to allow mobile-phone customers to pay locally using their devices when traveling outside their home countries.

TBCASoft will be using the IBM Blockchain Platform, IBM’s Hyperledger-powered enterprise blockchain solution.

TBCASoft technology helps “optimize” clearing between different carriers and transaction records, according to the announcement, and allows for the interoperability of mobile networks and the bolting on of networks of merchants to enable payments

Potential Value Opportunities

Defining ROI for IT investment projects - Jim Mason

A great architect friend of mine summarized guidelines for IT project investment. IF the solution requires a new business model or a new platform, it should not be considered unless there is a 10X ROI. If the project is a normal new IT solution or redesign of an existing solution or service, then a 3X ROI often works. In the case of DeFi extended to traditional fianncial services communities, there are often errors in the assumptions on "philosophical" changes needed in the community. On closer examination, the communities will have governance and operational changes BUT they may not be as much as DeFi advocates promote ( or hope ). Maybe a 3X to 5X ROI may suffice for new Web 3 solutions in those cases

Potential Challenges

ice phishing - DLT account delegation to a bad actor

"Smart contracts you interact with are immutable, often open-source, and audited. How do phishing attacks happen with such a secure foundation?" said Microsoft.

The 'ice phishing' technique doesn't involve stealing one's private keys. Rather, it entails tricking a user into signing a transaction that delegates approval of the user's tokens to the attacker.

"This is a common type of transaction that enables interactions with DeFi smart contracts, as those are used to interact with the user's tokens," Microsoft informed.

In an 'ice phishing' attack, the attacker merely needs to modify the spender address to the attacker's address.

This can be quite effective as the user interface doesn't show all pertinent information that can indicate that the transaction has been tampered with.

Once the approval transaction has been signed, submitted, and mined, the spender can access the funds. In case of an 'ice phishing' attack, the attacker can accumulate approvals over a period of time and then drain all the victim's wallets quickly.

This is exactly what happened with the Badger DAO attack that enabled the attacker to drain approximately $121 million in November-December 2021.

"The Badger DAO attack highlights the need to build security into web3 while it is in its early stages of evolution and adoption," said Microsoft.

"At a high level, we recommend that software developers increase security usability of web3. In the meantime, end users need to explicitly verify information through additional resources, such as reviewing the project's documentation and external reputation/informational websites," the tech giant added.

NFT theft on OpenSea - Phishing Attack and Ethereum design

https://www.youtube.com/watch?v=SpOvzaKdRWk

In the last few days about $1.7 million in NFTs were stolen from OpenSea users, and there is quite a bit of confusion about how it was done. In this video I talk about a number of "design decisions" in the Ethereum space, and their security issues. These include: token approvals, off-chain signing, how NFT decentralized exchanges work, and there is a bit about phishing emails thrown in for good measure. In summary, it doesn't look like OpenSea was to blame in this case, but just as we've been trying to hammer home the "don't share your seed phrase with anyone" security mantra, it appears that "take extra care when signing requests" needs to be emphasized too.

NFT theft on OpenSea - Phishing Attack and Ethereum design gdoc

NFT theft on OpenSea - Phishing Attack and Ethereum design gdoc

NFT: can represent ANY asset or service that has value and can authenticated

Vitalik Buterin

“For example, a person might have a Soul that stores SBTs representing educational credentials, employment history, or hashes of their writings or works of art,” the paper says.

What assets or services have a market value and represent a unique experience that can be represented by an NFT?

ah yes ....

The Problem With NFTs': A Crypto Expert Responds to a Viral Takedown

https://www.yahoo.com/news/problem-nfts-crypto-expert-responds-104049890.html

- Olson discusses what he perceives to be the blockchain’s security gaps, the hollow hype of NFTs, and the limited capability of DAOs.

- asked Tascha Che—a widely followed macro-economist and Web 3 investor who offers crypto education via essays and videos to her 121,000 Twitter followers—to respond directly to some of Olson’s specific critiques. I then went back to Olson to ask him to respond to some of Che’s rebuttals.

- bitcoin is disproportionately benefiting the earliest adopters. That’s why I think some of the projects in this space are unsustainable, because you cannot reward early adopters at the expense of new entrants

- Crypto adoption is growing at an astonishing rate worldwide:

- you have new innovations happening every day

- fraud -

vast majority of fraud comes from scammers inputting bad information from the start, by getting someone’s password. When you are tricked into doing something on the blockchain, all of the mechanics that follow are legitimate, according to the rules of the system. This has opened the door for every type of scam imaginable - The point of the system is a revolution in how we distribute value. The point is not inventing a system that is more secure than the centralized system

- NFT image for token not secure

in most cases there’s no cryptographic relationship between the image that an NFT points to and its token. - You can just swap out what’s being hosted at the end point of that URL

- What's unique about NFT?

- what you’re owning is the hash token onchain, and that in itself has all the benefits that blockchain offers: It’s immutable, decentralized, hard to destroy.

- there will be hyper-tokenization, and everything of value will find some kind of on-chain denomination

- blockchain is allowing everybody to create assets of value

- Is Web3 just new central services providers in reality? ( eg consensys opensea etc )

- There are decentralized alternatives, newer ones, trying to compete with OpenSea, like LooksRare, that has a co-op ownership model.

- DAO

- DAO only handles code-appropriate tasks: bookkeeping, digital signature verification, on-chain asset management. But that’s just a productivity tool. It’s a slow, inflexible tool for executing straw polls

- Yeah. Right now, DAOs cannot really do much. Anybody saying they are going to replace centralized organizations in the short term, that is entirely hype

- blockchain opens up new possibilities of governance

- Olson

- questions around Web 3 are very much centered around base functionality. This stuff doesn’t do what people say it does and it overwhelmingly exposes people to unnecessarily high risk and the burden of risk.

- Che

- Tokenization opens participation as investors

- With tokenization in crypto, everyone can invest in crypto startups—not just venture capital firms or high net-worth individuals —and these markets have liquidity like the stock market from day one. If you don’t like the volatility of startup investment, then don’t do it.

- Che on regulation

- Focus on education and risk disclosure, instead of having stupid bans that end up exacerbating social inequality

- << is this a viable stance for most financial needs that require safety, guarantees, insurance

Are NFTs dying off in 2022 after 2021 hype?

- NFT hype phase is ending

- NFTs have value as a delivery package for digital or physical content or assets that are truly unique ( an NFT for Buckingham Palace ?? )

- Ethereum POW is not a useful platform

- Ethereum POS after the Merge will be a better commercial platform with less risk, more predictable fees

NFT Growing Pains: ‘Blue Chip’ Success Exposes Ethereum Weaknesses And Market Strengths

Jim >>

Good article from Michael. As a blockchain technologist, content creator and former brand manager in the physical world, his insights all make sense. When hype peaks on a new trend, anything sells. After the hype dies off, it's the content, the brand strength, reputation and distribution channels that have the biggest impact on winners and losers in the market. Any truly unique entity ( digital or physical ) may benefit from an NFT delivery.

Web 3 is Moving the Internet to Securitization of Digital Assets

The Internet Is Just Investment Banking Now

web3-nft-2022-theatlantic.com-The Internet Is Just Investment Banking Now.pdf

Web 3 and NFTs run on centralized services

Web 3 has securitized all assets ( real and digital )

Candidate Solutions

DeFi Dev Tool Concept for Public Chains. slides

Alchemy Blockchain Interoperability tools list. - see Kaleido, Cacti as best

Other Financial Market Solutions - Kamlesh Nagware

https://www.linkedin.com/pulse/dtccs-dlt-based-settlement-platform-parallel-follow-kamlesh-nagware/

Ravi Menon, Managing Director of the Monetary Authority of Singapore, at the Green Shoots Seminar, Singapore, 29 August 2022 mentioned that Blockchain could play important role in real-time efficient clearing & settlement system. Below are some excerpts from his presentation, you could read a more detailed interview here on BIS official website https://www.bis.org/review/r220830d.htm : -

· In cross-border payments and settlements, wholesale settlement networks using distributed ledger technologies such as Partior – a joint venture among DBS, JP Morgan and Temasek – are achieving reductions in settlement time from days to mere minutes.

· In capital markets, Marketnode – a joint venture between SGX and Temasek – is leveraging distributed ledger technology to tokenise assets, which reduces the time needed to clear and settle securities transactions, from days to just minutes.

· Wholesale CBDCs on a distributed ledger have the potential to achieve atomic settlement, or the exchange of two linked assets in real-time.

· JP Morgan has established its digital asset capabilities in Singapore via its Onyx division, which has pioneered several DLT-based products and initiatives. Offerings include round-the-clock real-time fund transfers with shorter settlement times and no intermediaries.

Bitcoin Layer 2 for fast, DeFi solutions

https://cointelegraph.com/news/defi-is-not-decentralized-at-all-says-former-blockstream-executive

As Mow pointed out, DeFi projects are governed by entities that can modify the protocol at will.

“Bitcoin, at the fundamental level, is money, and it should be immutable,” explained Mow. “If you can change it at will, then you’re no better than a fiat currency governed by the Fed.”

Bitcoin’s (BTC) decentralization makes it very difficult to modify its protocol, which is why Mow considers it a unique candidate for becoming a truly global monetary system.

Mow pointed out that despite the immutability of Bitcoin’s base layer, developers can still build applications on the Bitcoin blockchain by working with its layer-2 scalability solutions.

In particular, Mow is a strong proponent of the Lightning Network, which allows instantaneous, cheap Bitcoin transactions. By promoting Lightning technologies, Mow is trying to accelerate the path toward hyperbitcoinization — a situation where people will be exchanging Bitcoin without the need to convert it into fiat currency.

“Lightning will displace Visa, Mastercard and everything else,” he stated. “And it reduces costs for merchants, which means better experience and savings for consumers.”

BSTX exchange SEC approved to trade derivatives ( and more ) using blockchain

https://news.yahoo.com/u-sec-approves-u-exchange-181013074.html

BSTX, aims to launch in the second quarter, said Jay Fraser, a director. It will initially trade securities, such as stocks or exchange-traded funds, first listed on its exchange, but those securities would be tradable on rival bourses.

BSTX ultimately aims to expand trading to all U.S. stocks and potentially tokenized securities, Fraser said. Stock tokens are digital versions of equities pegged to the underlying share, usually traded in fractional units.

Fraser said the aim is for BSTX to look "more like" crypto exchanges such as Coinbase as opposed to traditional exchanges like Nasdaq.

In addition to traditional pricing data feeds, BSTX plans to offer a market data feed that will operate on a private blockchain. That feed will allow exchange members to see their own activity, as well as the activity of other BSTX participants on an anonymized, delayed basis, the exchange filing said.

The exchange plans to expand its use of blockchain, the technology that underpins cryptocurrencies such as bitcoin, over time to support products like tokenized securities, Fraser said.

BSTX was originally going to be called the Boston Security Token Exchange and planned to exclusively trade tokenized securities, but the SEC rejected that plan in December of 2020.

The exchange will also give members the option to settle trades as quickly as the same day, as opposed to the current two-day standard settlement time, which would free up cash counterparties have to pledge against trades while also reducing the risk of either party defaulting.

The securities industry as a whole is currently debating moving to single-day settlement.

IBM Food Trust Network

| https://www.ibm.com/blockchain/solutions/food-trust | IBM Food Trust Network |

| https://www.ibm.com/downloads/cas/E9DBNDJG | Food Trust Overview ( view here ) |

| https://github.com/IBM/IFT-Developer-Zone/wiki/doc-Message-Types | Message Types |

| https://github.com/IBM/IFT-Developer-Zone/wiki/APIs | Food Trust API's |

| https://food.ibm.com/ift/api/connector/swagger-ui.html | Swagger Tests for API's |

| https://www.gs1.org/sites/default/files/docs/epc/EPCIS-Standard-1.2-r-2016-09-29.pdf | EPICS standard for trading partners |

Food Trust Value List

| Value | Features | Description |

|---|---|---|

| Safety | Transparency Traceability | Trace food instantly – with end-to-end supply chain data visibility – to help ensure food safety and regulatory compliance. |

| Supply chain efficiency | Shared immutable ledger | Access a shared and immutable digital ledger in real time – rather than ink on paper – to find choke points and uncover opportunities to speed your supply chain. |

| Food Freshness | Traceability Shared data | Gain instant and efficient food tracing from source to consumer to more accurately judge peak freshness and remaining shelf life – and reduce product loss. |

| Sustainability | Shared data Immutable ledger Smart contracts | Rely on shared data and an immutable ledger to help ensure the promised quality of products and that food comes from a sustainable source. Smart contracts improve data quality |

| Brand Trust | Transparency Traceability | Gain a competitive advantage as you add transparency and specificity about the sourcing of your food products. Build trust in the safety and quality of your brand. |

| Food waste | Shared data | Identify waste hot spots and speed responsiveness using better visibility into your food supply chain. Reduce costly food waste and boost your bottom line. |

| Food Fraud | Shared data Immutable ledger Smart contracts | Data-sharing across the food supply helps eliminate chances for fraud and errors – and can help preserve the integrity of raw materials, products, and packaging. |

Verified.me - a secure blockchain identity framework for Canadian banks on IBM Blockchain

Verified.Me, by SecureKey Technologies Inc., is the new and secure way to help you verify your identity, so you can quickly get access to the services and products you want online, in person and on the phone.

Verified.Me helps verify your identity using personal information that you consent to share from your Connections, like your financial institution, with service providers you want to transact with.

https://verified.me/wp-content/uploads/2019/04/VerifiedMe_General_Overview_Script_EN-1.pdf

Fetch.AI - smart blockchain tokenomics framework

Agents

Fetch.AI is a decentralised digital world in which useful economic activity takes place. This activity is performed by Autonomous Agents. These are digital entities that can transact independently of human intervention and can represent themselves, devices, services or individuals. Agents can work alone or together to construct solutions to today’s complex problems.

Open Economic Framework

The digital world in which agents live is called the Open Economic Framework (OEF). This world acts as the ultimate value exchange dating agency: each agent sees a space optimised in real-time just for them, where important things are clear and visible and less important things are simply removed. The OEF provides the senses for agents: their sight, touch and hearing to present to them a world unique to the viewer.

Smart Ledger

Underpinning the digital world is the smart ledger: a new generation of learning ledger that provides a collective super-intelligence to support agents’ individual intelligences. It provides market intelligence, previously locked up in centralised silos, to everyone so that any agent that wants something is assured of the shortest possible route to find another that has it. Fetch.AI’s smart ledger scales to support millions of transactions per second and is able to restructure itself to present the OEF’s digital world to the agents that use it.

#Open Banking API

https://www.openbankproject.com/platform/

The global standard and API solution for the financial services industry

Create, test and manage financial-grade APIs to share data safely and build better applications faster.

The OBP platform seamlessly connects to any system to expose data and services through a catalogue of prebuilt and standardised API endpoints.

Organisations use OBP to share data

with third parties, integrate external services, and streamline internal processes.

Open Banking API Whitepaper

A Whitepaper for Open Banking and Open Data Ecosystem Participants Globally

APIs are the best way to open up consent-driven access to user data and are ubiquitous in the digital world. Much of the software that we use in our daily lives is powered by services delivered via APIs. The ability to get navigation directions, order delivery online, and communicate with email are use cases where data is provided via APIs. However many of these APIs are proprietary, although they may follow certain international standards, they are built to allow one company to use the services of another company. Such APIs are typically market driven and have a clear commercial rationale to be built and consumed by all parties.

There are several categories of APIs however where the commercial rationale is not as straight-forward, for example:

● Accessing bank account information (or any financial account information including checking, savings, stocks, bonds, mutual funds, and insurance)

● Initiating a payment directly from a bank account

● Accessing health information

● Accessing usage and tariff data from utility companies and telcos

Ecosystem collaboration is required to deliver these use cases, because bilateral implementations amongst all market participants is not viable at scale. Ecosystem-wide collaboration has emerged from industry-led efforts (with financial incentives) or reciprocity between participants, but widespread global adoption of open data APIs is hindered by several factors:

1. Competition: By restricting access to data, companies make it harder for consumers to directly compare services, thus making it less likely for customers to move.

2. Control: Private companies prefer that any interaction with their services or data take place through an interface the company controls.

3. Security: opening up APIs is seen as opening up additional attack vectors.

4. Strategic: Many finance companies are scared of becoming high-cost “dumb pipes”, i.e. providing the expensive and risky plumbing but having no interaction with the end user, (and therefore no opportunity to sell more services).

Source: Open ID

Open Banking, Open Data and Financial-grade APIs

Open Banking, Open Data and Financial-grade APIs-report.pdf link

Open Banking, Open Data and Financial-grade APIs-report.pdf file

Data is often referred to as the “new oil” of the digital economy. It is a powerful asset used by companies to improve their services and to build artificial intelligence (AI) models. However data can often be used to “lock” consumers into a service. A move to consentdriven access to all user data can break that lock, make it easier for consumers to move between different service providers and unleash a wave of innovation.1 Open Banking can also help facilitate financial inclusion, better serving those on the margins of society by offering a bridge to the formal economy. A