DeFi - Tokenized DvP use cases p1

Key Points

- Tokenized DvP use cases

- Role of governance, regulations, compliance, taxation, multiple jurisdictions

- Refactored roles for intermediaries

- Use of existing institutions for trade, settlement?

- Separation of applications & solutions from an FSN or DAP?

References

| Reference_description_with_linked_URLs_______________________ | Notes______________________________________________________________ |

|---|---|

| m Blockchain Financial Services - DeFi - NFTs | |

| POS Proof of Stake and Liquidity Pools | |

| DvP Delivery vs Payment Settlement Concepts | |

| VCE > Value Chain Economies: micro economies for value-chain communities ( VCC ) | |

| m Public Sector - LFDT | |

| Future of Money | |

mica-summary-2023.pdf. file | |

| linkedin defi overview concepts - weak link |

Key Concepts

Digital Asset and Tokenized Finance Concepts

vision-of-tokenization-of-finance-swiss-fintech-2023.pdf. link

Institutional-DeFi-The-Next-Generation-of-Finance.pdf - Future of Money - JPM, Oliver Wyman ..

<< Crypto crowd sees DeFi as successful direction. I see ReFi - big difference >> Jim

The cost savings and new business opportunities of creating a “tokenized” version of real-world assets for transacting through DeFi protocols could be significant for issuers and investors, as well as for financial institutions that can adapt their technology and business models

Institutional DeFi = ReFi = Re-imagine Finance

the idea of Institutional DeFi – a system that combines the power and efficiency of DeFi protocols with a level of safeguards to meet regulatory compliance and customer-safety requirements. Many existing DeFi protocols lack identity solutions to enable institutions to meet anti-money laundering (AML), your customer (KYC), and combatting the finance of terrorism (CFT) requirements

Jim's Keys for ReFi success:

- blockchain – which underlying network to build on and what information is visible to whom;

- participation – the mechanisms that determine who can develop and access solutions,

- token design– how tokens are issued, transacted, settled, and standardized.

- regulation, governance and compliance systems

- new economic value propositions for existing parties and roles

Evolution of financial asset proxies

Paper securities, deeds > siloed electronic book records at SOR institutions > tokenized assets on regulated, interoperable shared ledgers with DID, VCs as new SOR

Each system had counter-parties, effective trusts required, protections on risks to be successful

The first blockchain

The-Path-Forward-For-Digital-Assets-And-Crypto-In-2023.pdf

The challenge ahead – for digital asset businesses, investors, developers, policymakers, and consumers – is to focus on that promise, identify and rectify the flaws, and develop rules of the road (both formal and informal) that offer protections for investors and users while fostering truly valuable innovation.

<< ReFi - not DeFi -

surprise - we already have rules proven effective through the existing financial systems ( compared to DeFi ). the improvement opportunity is making assets digital for automated transactions and settlement reducing frictions, lowering costs while improving security. The solution is not re-invent financial systems with DeFi, it's to ReFi - Re-imagine how to make existing systems more effective >>

CBDC is digital money backed by central banks

Stablecoins are not yet regulated well so their backing is a risk for the buyer

Deposit Tokens will have clearer backing ( similar to commercial paper ) if they are an option for existing commercial paper regulations

<< DeFi needs to move aside for ReFi

After several years, we see DeFi solutions have higher risks, less regulation and higher losses on thefts, etc than traditional financial systems.

Time to apply digital technologies to existing financial systems and institutions for better efficiencies in a well-regulated economy >>

What's coming in digital money? >> Jim

- Applying digital technologies to existing institutions and systems for better efficiencies for all parties

- "Leaning in to Governance" >> Improvements in standards and regulations for all financial assets and transactions including digital money ( see MICA, US etc ISO-20022 )

- New forms of regulated digital money - CBDC, deposit tokens, etc

- Modified roles for existing financial institutions

- Improved Interoperability for secure financial transactions across networks ( APIs, blockchain interoperability protocols etc )

- Bitcoin and other unregulated digital money systems will remain a small part of the world's banking system

Connected Financial Services Networks

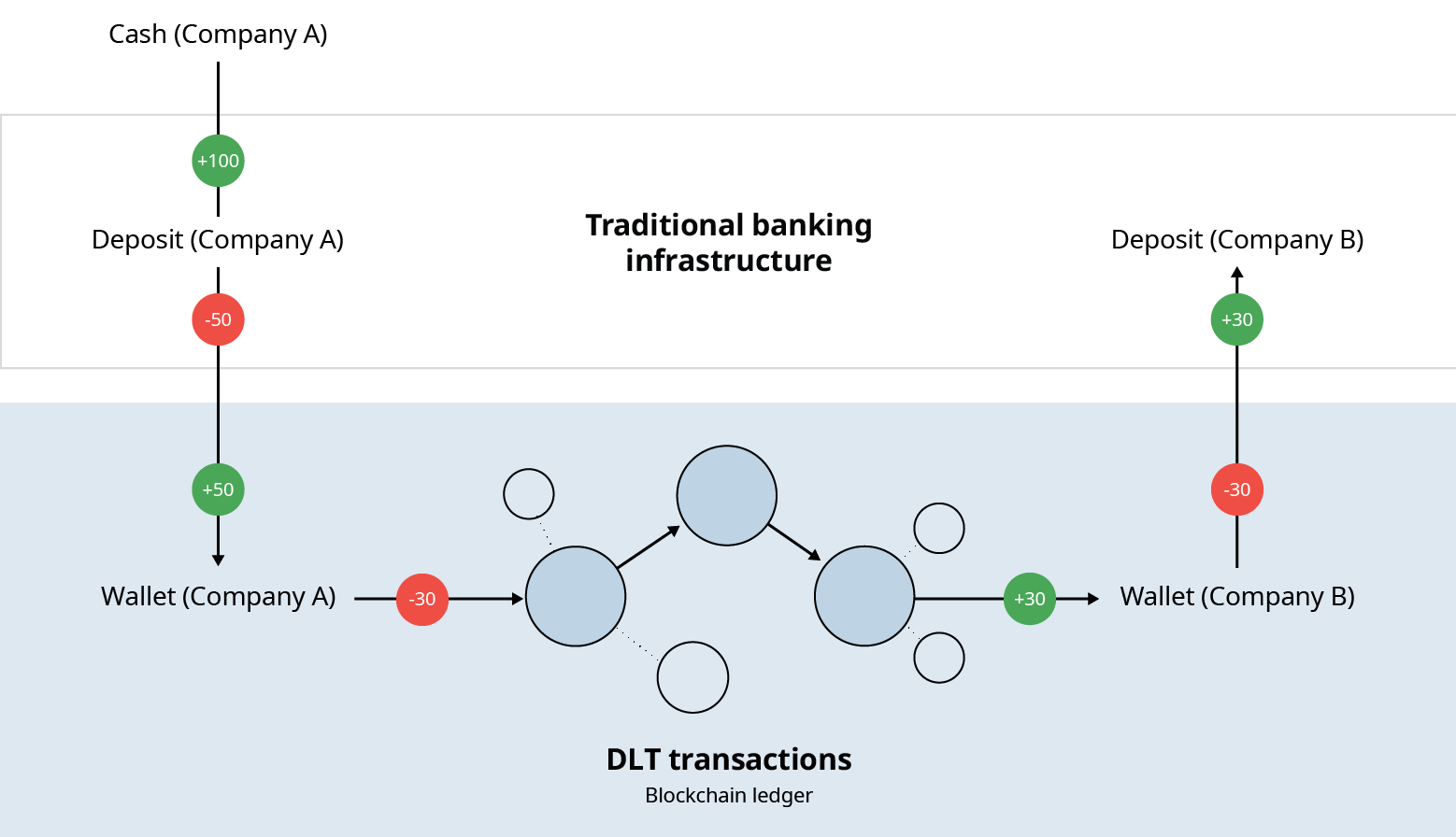

Deposit Tokens - foundation for digital money in financial transactions like commercial bank paper

- Deposit Tokens = Digital Money

The increasing attention and ongoing development of blockchain technologies highlight the need for blockchain-native “cash equivalents” — instruments that act as liquid means of payment and stores of value in blockchain-native environments. - Deposit Tokens = a depositor asset + a bank liability

This demand has predominantly been met by stablecoins historically. However, the possible adoption of blockchain for payments and complex commercial transactions at scale, including sophisticated institutional activity, raises questions as to what forms of digital money will be best suited to support the transfer of value on blockchain systems. - Blockchain-based deposit tokens are a promising, emerging form of digital money. They are the equivalents of existing deposits, held by a licensed depository institution such as a commercial bank, but recorded on a blockchain. From an issuing bank’s perspective, deposit tokens are simply a redistribution of deposit liabilities on the bank’s balance sheet, with no changes in the bank’s composition of assets.

tokenized deposits can support a variety of use cases including domestic and cross-border payments, trading and settlement, and provision of cash collateral. In a token form, commercial bank money becomes a programmable instrument that operates 24/7 and can be transferred instantly, without relying on intermediaries. These technical features allow “deposit tokens” to express sophisticated payment operations and to act as collateral that travels within minutes.

The reliability of deposits, backed by the issuer’s safety and soundness regulation, capital and liquidity requirements, access to contingency funding through the central bank, and strong consumer protection policies mean that deposit tokens are designed to be a money instrument at scale that promotes financial stability.

Deposit Tokens could be settled by existing banking systems ( if not using banking 3rd parties like Fiserv, M&T, Jack Henry )

Users should be able to treat physical cash, non-tokenized digital money and various money-like tokenized assets as interchangeable assets with equal monetary worth and different technological properties. For deposit tokens that represent commercial bank money, this fungibility is facilitated by designs in the current banking system where central banks already act as trusted settlement institutions for private money issued by commercial banks.

Adoption of Deposit Tokens driven by market acceptance and efficiencies

requires interoperability between traditional finance systems and blockchains, interoperability across different chains and interoperability with other assets on a given blockchain.

oliver-wyman-jp--morgan-deposit-tokens-report-final.pdf whitepaper on use cases

Use cases for deposit tokens:

- Payments

- Programmable Money

- Protocol Interaction

- Trading and Settlement

- Collateral

Difference with CBDC and Deposit Tokens is who backs them. CBDC backed by central banks. Deposit Tokens backed by issuing institution and any related insurance coverages

deposit token would enable the direct, peer-to-peer transfers of funds, which can also include bank-to-bank transfers to benefit customers off-chain.

In this peer-to-peer model, the bank’s role shifts from direct intermediation and clearing of every transaction, to establishing controls in the design of the deposit token and, if relevant, in the environment it chooses to issue deposit tokens in to create a trusted environment for funds transfers.

<< the real change here is moving the control of the asset swaps from off-chain solutions with existing oversight to on-chain transactions with on-chain control by smart contracts and oversight by observer nodes >>

MAS Project Guardian on Deposit Token Transfer

For example, in MAS’ Project Guardian, whereby JPMorgan issued SGD deposit tokens for an FX pilot transaction opposite an affiliate of SBI Digital Asset Holdings (SBI) on a public blockchain, the tokens and protocol which facilitated the transaction were designed to restrict unknown parties from transacting with the SGD deposit tokens — both the token smart contract and transaction protocols were programmed to only interact with certain known blockchain addresses. The deposit token smart contract also required authorized parties who instructed transfers to attach a “verifiable credential”, developed by JPMorgan, that was provided by the issuer. The Project Guardian pilot demonstrated that even in providing a tool for peer-to-peer transfers on public blockchain, banks can implement controls within the funds transfer process. Digital identity tools, such as the verifiable credentials developed by JPMorgan, can support these transfers by ensuring that transactions are only executed with verified counterparties.

BIS DeFi tokenization benefits for finance

Key takeaways:

- Embrace Private-Sector Innovation: Many private tokenization projects are emerging and central banks may need to foster interoperability among these to avoid fragmented markets.

- Settlement Choices Matter: Different forms of digital money (CBDCs, stablecoins, tokenized deposits) each have trade-offs. Finding the right mix is crucial. Expect a blend of traditional and tokenized assets in tomorrow’s payment systems.

- Regulation & Oversight Are Crucial: New token platforms must meet the same rigorous standards for security, governance, and risk management as traditional systems. Enterprises should build with compliance in mind from day one.

- Watch Monetary Policy Impacts: Widespread tokenization might alter how money flows and how central banks influence the economy. Firms should stay agile as policies evolve around digital assets.

BIS-2024-tokenization-impacts-of-money-assets.pdf. GD

BIS-2024-tokenization-impacts-of-money-assets.pdf

Potential Value Opportunities

Potential Challenges

Candidate Solutions

Step-by-step guide for Example

sample code block